Benchmarking effort reveals food industry’s leaders and laggards

Danone, Nestlé, Starbucks and General Mills are among the companies highlighted by Ceres for working to reduce emissions. The post Benchmarking effort reveals food industry’s leaders and laggards appeared first on Trellis.

Key takeaways

- The industry is making solid progress on core disclosure and target-setting measures.

- Forward-looking companies are setting targets for methane and quantifying the impact of reduction strategies.

- Retailers tend to score more poorly than food brands.

The latest food-industry benchmarking exercise from the non-profit Ceres provides an opportunity for companies in the sector to figure out if they’re a leader, laggard or somewhere in between.

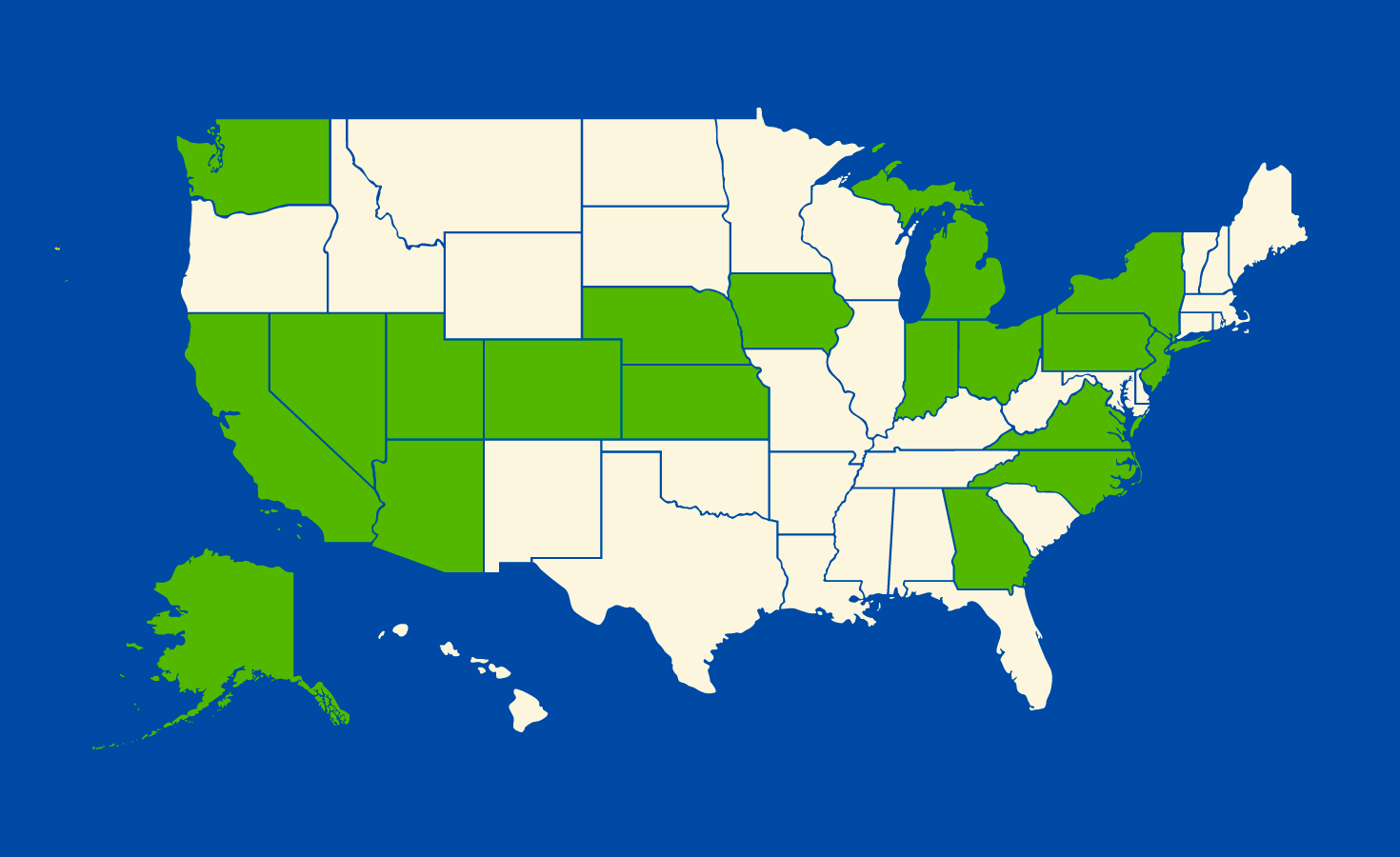

The organization looked at 50 of the largest food and agriculture companies in North America, assessing each on their emissions targets and disclosures. Companies that achieved threshold scores for disclosure and target-setting were then assessed for other indicators, including procurement strategy and customer engagement.

Table stakes

The two core indicators covering targets and disclosure can be seen as table stakes in discussions of climate commitments.

On the disclosure side, the Ceres team looked at three metrics: published data for Scope 3 emissions from goods and services, agriculture and land-use change. For targets, the metrics were whether Scope 3 data was included and if the target was aligned with 1.5 degrees Celsius of warming. An overview reveals:

- 32 of the 50 companies achieved at least partial success on the two indicators.

- Nine companies achieved all five metrics: Campbell’s, Danone, General Mills, Hershey, McDonald’s, Mondelez International, Nestlé, Starbucks and Yum! Brands.

- Eight companies did not hit any of the five metrics: BJ’s Wholesale Holdings, Bloomin’ Brands, Darden Restaurants, Flowers Food, Kroger, Loblaw Companies, Performance Food Group and Texas Roadhouse.

Beyond the basics

When Ceres first benchmarked food and ag firms in 2021, “barely any companies were disclosing Scope 3,” said Carolyn Ching, who directs the organization’s research on food and forests. As Scope 3 disclosure has become more common, Ceres has added metrics to its exercise to capture more advanced steps that leaders are taking:

- Climate scenario analyses aligned with 1.5 C of warming help identify risk and opportunities in the transition toward a more resilient food system, Ceres argues. Archer-Daniel Midlands, Compass Group and Post Holdings are among 16 companies that have conducted such analyses.

- Emissions of methane and nitrous oxide — from livestock and fertilizer, respectively — are a particular problem in food and ag. Three companies have recognized this by setting gas-specific targets: Nestlé and Danone for methane, Campbell’s for nitrous oxide.

- Quantifying the expected impact of specific reduction strategies allows companies to manage risk and create value, the report suggests. Amid the five companies that have done so, “General Mills stands out with its Climate Action Transition Plan that discloses reduction amounts by category and provides implementation timelines,” according to the report.

Sector trends

The Ceres team did not rank companies across all the metrics, arguing that do so would involve attaching arbitrary weights to the indicators. But broad trends can be discerned from the data. They include:

- Half of the 18 companies that were not ranked on the additional measures — because they did not score highly enough on the basic disclosure and targets indicators — were retailers.

- Food brands tended to rank higher. Ching suggests this may be because retailers work with a broad set of products, while food brands are closer to agricultural producers and more able to drive down supply chain emissions.

- The sector as a whole continues to perform poorly on some disclosure metrics. Not a single company has committed to aligning its capital and operating expenditure with its emissions reduction targets, and no company has fully disclosed its progress for addressing emissions from acquisitions and divestments.

The post Benchmarking effort reveals food industry’s leaders and laggards appeared first on Trellis.

![[Industry Direct] PHI Studio & Agog Are Seeking Immersive Artists for a Four Week Residency Program](https://roadtovrlive-5ea0.kxcdn.com/wp-content/uploads/2025/05/phi-immersive-residency-2-341x220.jpg?#)