How 2 startups turn imperfect clothes into a business opportunity

Alternew and Revive are partnering with fashion brands to profit from repairs and alterations while keeping clothes out of closets, warehouses and landfills. The post How 2 startups turn imperfect clothes into a business opportunity appeared first on Trellis.

Waste was already baked into apparel business models long before social media influencers made styles lose their coolness on a weekly rather than a seasonal basis. But even as fast fashion drives unprecedented waste, many brands, retailers and startups are slowly advancing circular business models that keep garments in use.

New software startups are rescuing less-than-perfect items, revealing details through artificial intelligence about how brands, retailers and consumers behave. These emerging services are pitching new efficiencies that help to restore or customize clothes, shoes and accessories that otherwise go stale in warehouses, closets or landfills.

In New York, Alternew seeks to streamline consumer repairs and alterations, while Revive is flipping returned goods into new sales for brands. Other repair and refurbishment ventures: Suay Sew Shop formed in 2017 in Los Angeles; Mendit opened in 2019 in Houston; Sojo formed in London in 2020, as did ReCircled in Denver; and Circulo came to life in the U.K. in 2024. And this past February, the Loom app debuted to connect people with designers to “upcycle” their clothes. Tersus Solutions spiffs up used clothes and shoes for scores of branded resale portals.

Of course, Nordstrom and Bloomingdale’s long ago set the bar in retail by offering customers alterations at most stores. And starting 20 years ago, brands such as Levi’s, Patagonia and The North Face launched free or low-cost repair programs, while more recently Ralph Lauren, Arc’teryx, Dr. Martens and Timberland have followed. Meanwhile, in addition to its no-cost consumer repairs, Eileen Fisher offers special Mended collections that concoct new garments out of spare parts from old ones.

Low-hanging opportunities

All of these companies are pursuing a share of repair as a business opportunity, one that is attracting even more interest lately as tariffs bring turmoil to supply chains and legislation here and abroad around end-of-life textile management adds pressure on brands.

- The market for fashion repairs, which has been growing by 2.5 percent annually, will expand from $3.6 billion in 2024 to $4.5 billion by 2033, according to Business Research Insights.

- Circular business models, including repairs and reuse, could reach $700 billion by 2030, the Ellen MacArthur Foundation projected in 2021. That’s more than 20 percent of the worldwide fashion market.

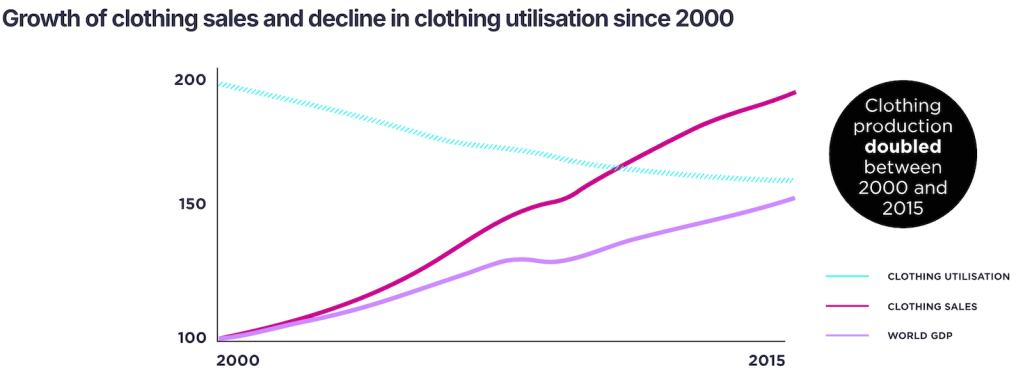

- As clothing production has doubled in the first 15 years of this century, the average number of times that someone wears a garment has dropped by 36 percent.

“Even with production separated from consumption, the negative impacts of fashion’s environmental footprint are becoming harder to ignore,” said former Timberland executive Ken Pucker, a business instructor at Tufts and Dartmouth universities. “Images of trashed clothing, consequences of microfiber release and accelerating carbon emissions compromise the planet and, ultimately, the viability of the industry.”

Recent research has quantified that repairs have more power than secondhand sales to prevent or delay new purchases. Eighty-two percent of repair services displace the purchase of a factory-fresh garment, compared with 60 percent for resale services, according to the nonprofit Waste and Resources Action Programme (WRAP). It saves 16 pounds of CO2, roughly equivalent to driving a gasoline car for 20 miles, to repair a cotton T-shirt instead of buying a new one, the report found.

Alternew: connecting brands, consumers and tailors

“There’s a landfill out there with my name on it that I’m personally responsible for,” jokes Nancy Rhodes, cofounder and CEO of Alternew. The former footwear designer’s creations, including for Beyoncé’s House of Dereon and Kenneth Cole, sold at Bloomingdale’s, Nordstrom, Marshall’s and Costco.

Now she’s building a matchmaking service for brands, consumers and tailors. Alternew, which captured $2 million in pre-seed funding in September, is working on a pilot with New York womenswear label Faherty. Brands Everlane and Moose Knuckles are interested in partnering, too.

Retailers spend hundreds of billions of dollars on “returns and churns,” and brands spend billions to lure customers to the register only to lose them after the sale, she noted. “Seventy percent of all apparel returns are due to poor fit,” Rhodes said. “The fashion industry has a 26 percent retention rate when using care and repair services as a brand. There’s data from the market that says a customer is 73 percent more likely to go back to the store within the year based on the services.”

Rhodes described a shopping experience that Alternew would prevent: You try on a pair of pants in a store, but they’re too long, so you walk out empty handed. “Instead of losing the sale, the store associate logs an alteration request immediately [on Alternew], matching you with a local, vetted tailor on our platform, you get a text notification with appointment details, pricing, and then real-time updates.”

That’s an opening for brands to differentiate themselves, according to Rhodes: “Care and repair are an intrinsic core solution to creating an authentic, holistic and circular experience for the consumer.”

Alternew can also provide companies new insights into their merchandise. For instance, maybe 20 zippers on a denim jacket broke across the country, or a high percentage of New England buyers hemmed wide-legged linen pants by 4 inches.

And Rhodes bets that by making it easier for consumers to hem pants or seal busted seams, more people will continue wearing their favorite brands.

“We started by creating a business in a box for tailors, and that allows us to get proprietary data that doesn’t exist today, so we can match the right tailor with the right product,” she said. “Because the tailor that hems a pair of jeans isn’t necessarily the same tailor that’s going to take in a Gucci blazer. Customers get a perfect fit, and tailors get new clients.”

Revive: Making repairs at scale

Revive originated out of Hemster, a repair and alterations startup founded in 2017 that has serviced Zara, Diane von Furstenberg and Reformation. Yet Co-founder and CEO Allison Lee swerved in a different direction in 2022, when she noticed brand warehouse managers using the service’s business-to-consumer repair portal to process dead stock and damaged goods.

Said Lee: “That’s really how we accidentally discovered this huge problem that brands seem to have around their inventory and debt, the damages and returns and such.”

After raising $3.5 million in seed funding last June, Revive became profitable at the end of 2024. Lee said it processed 500,000 units last year, which could triple in 2025. “There’s a lot of tailwind we’re feeling right now,” she said, as brands reevaluate their supply chains due to tariffs.

Brands create $740 billion of unproductive inventory annually, “the equivalent of every single unit sold on Amazon going directly to landfill,” Lee said. Yet companies only write off one-tenth of their inventory.

Brands often categorize returned items as “damaged” despite what are often trivial issues, including cat hair, wrinkles, a tear in the plastic wrap or a dent in the shoebox. Instead of recycling or donating those goods, Revive cleans, sews, re-tags and repacks them. Revive can help brands sell 95 out of 100 items it processes, according to Lee. The company re-routes the remainder for recycling or donations.

Revive, which takes a fee for the logistics and a commission for each sale, sits between brands and several third-party logistics companies across the U.S. It moves merchandise in a few weeks that might otherwise rot in a warehouse for a whole season. The service combines its inventory records with pricing data from 30 sales channels, including Macy’s, Nordstrom, eBay and Poshmark, in addition to influencers who livestream sales.

“We basically look at this clean system on record and we’re like, oh, Michael Kors handbags sell really well on Whatnot, but the shoes sell better on Poshmark,” Lee said of patterns Revive’s artificial intelligence reveals.

“The sustainability narrative puts too much pressure on consumers to buy better and throw out less,” Lee said, but the bigger impact is in reducing business waste. “The items that I’m getting from the brand equal a million people reselling their goods, and that’s coming from like four brands.”

The post How 2 startups turn imperfect clothes into a business opportunity appeared first on Trellis.