Gap, Target bet on Swedish recycling startup

The three brands have entered into strategic partnerships with Syre, which has already received a $600 million commitment from H&M. The post Gap, Target bet on Swedish recycling startup appeared first on Trellis.

Gap, Target and Houdini Sportswear have pledged to purchase circular polyester from recycling startup Syre — even before it has a product to sell. The mall giant, the big box tastemaker and the Scandinavian outdoor brand are each betting on a “hyperscale” future for polyester recycled from clothes and scraps otherwise destined for the trash.

The three companies each announced strategic partnerships with Syre on June 24. Gap Inc. seeks to buy 10,000 metric tons of Syre’s polyester annually. That would serve the San Francisco company’s aim to integrate 100 percent “sustainable” materials across its Gap, Old Navy, Banana Republic and Athleta brands by 2030.

“This partnership enables us to accelerate our progress toward realizing a more circular fashion industry,” Dan Fibiger, vice president of global sustainability at Gap, said in a statement. “Our ambition to utilize 10,000 metric tons per year of Syre’s recycled polyester chip is not only an innovation that we feel will resonate with our customer, but it is an important lever for Gap Inc. in our efforts to bridge the climate gap.”

Minneapolis-base Target plans to integrate Syre polyester into its own branded products, with an eye towards design “for a circular future” in those lines by 2040.

Houdini Sportswear of Stockholm, the first brand Syre connected with, has committed to getting half of its polyester from the startup over three years.

Syre hopes to help drive what CEO Dennis Nobelius calls “the great textile shift,” in which recycled fabrics don’t go to landfill or incinerator. The company says its recycled polyester pellets reduce climate emissions by 85 percent compared with virgin polyester. With more brands on board, Syre can engage fiber spinners, fabric manufacturers and garment producers across recycled-textile supply chains, he noted.

“This is a credit to the drive by the brands right now to go circular, seeing the benefits of sustainable fashion and apparel,” Nobelius said. “Right now, many are trying to lock in capacities, seeing that there are not many textile-to-textile recyclers out there in the world, at least not with the ambitions and the scale that we are going for.”

Joining the crowd

The venture, like other textile recycling startups, faces the challenge of scratch-building not just a company but a circular economy that involves numerous stakeholders, locations and exchanges of materials. Reju, Samsara Eco, Carbios, Ambercycle and Circ do not complete the list of early-stage companies in the increasingly crowded textile-to-textile recycling space. Earlier in June, Samsara Eco inked a 10-year deal to supply a significant amount of recycled polyester to Lululemon. Several weeks earlier, Reju shared plans to open a massive Netherlands plant.

Syre has a leg up thanks to a $600 million promise from H&M Group, also of Stockholm. In March 2024 the brand agreed to spend that much over seven years to purchase polyester from Syre. Representatives from H&M serve on the board of Syre, which has been working for more than a year with the fast fashion brand’s operations team in Hong Kong.

“But really from the get go, they said that this is not an H&M venture,” Nobelius said. “This needs to be an industry movement. That’s the only way to make a big supply at scale and to make an impact on sustainability targets.”

Syre is speaking with other brands and retailers, too.

Small steps

For now, the young company’s intentions to operate at what it has billed as “hyperscale” have materialized in a pilot plant, blueprints and a brownfield. Syre’s pilot and R&D plant in North Carolina generates 1,000 metric tons of recycled PET. An hour and a half away, a brownfield site in Cedar Creek is the destination for a larger plant to generate 10 times as much polyester per year. Syre’s eventual Vietnam facility is supposed to create 150,000 to 250,000 metric tons per year.

The company is vying for three “gigascale” factories by 2027, which will crank out 3 million metric tons of circular polyester annually by 2032, preventing 15 million metric tons of emissions of carbon dioxide equivalent.

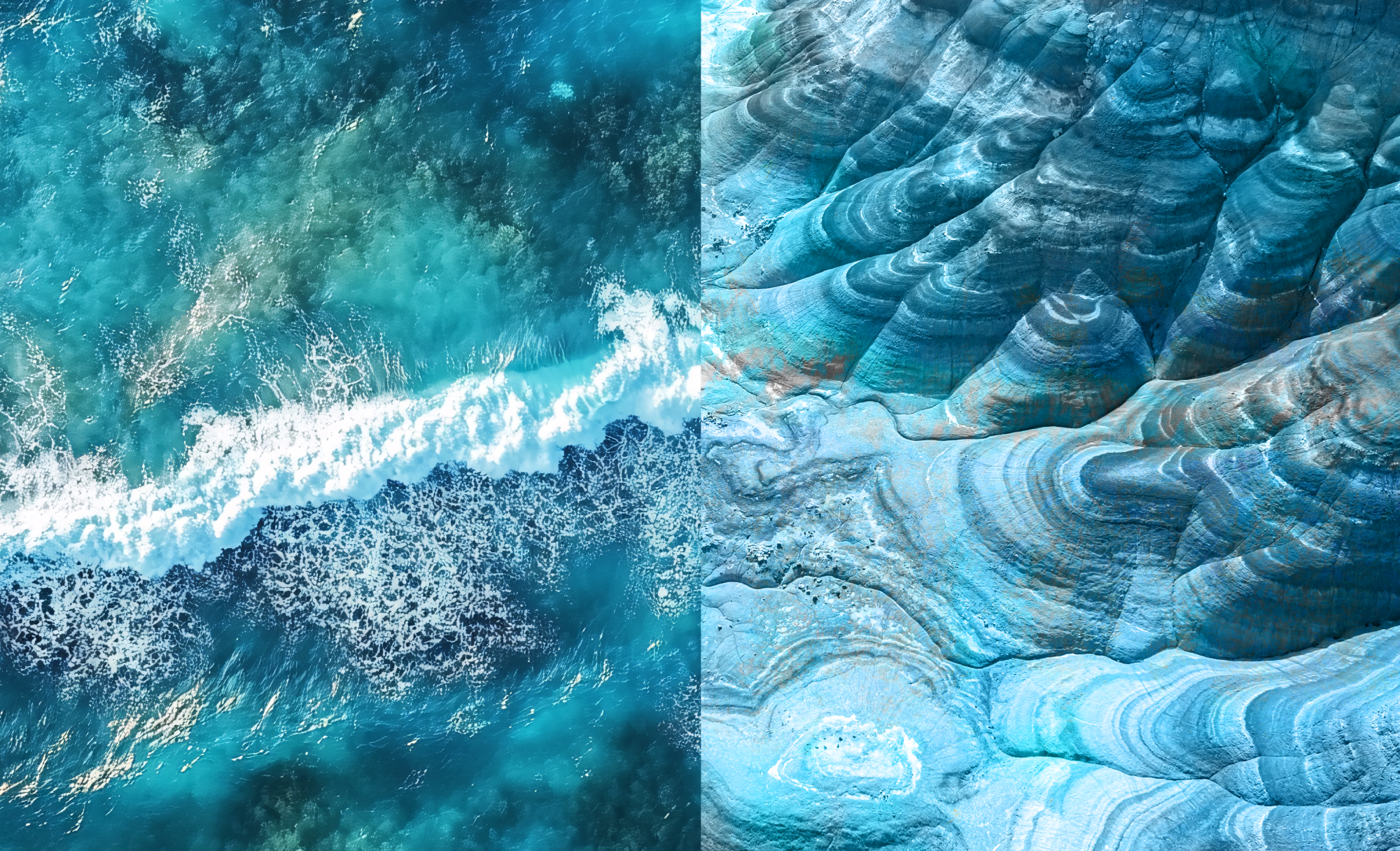

Syre’s low-pressure, low-heat chemical recycling technique uses polyethylene glycol as a catalyst. (The chemical also features in laxatives, skin moisturizers and industrial lubricants.) Its closed loop recycling process, meant to handle mixed textiles such as popular polyester-cotton blends, breaks down the polyester into monomers, then builds that back up to a polymer.

Syre is working with partners to secure textile waste in America, Europe and Southeast Asia. In North America, the feedstock is likely to come from people’s closets. In Binh Dinh province in the south of Vietnam the feedstock is likely to be post-industrial material.

Syre analyzed the landscape with McKinsey, mapping 400 apparel brands, 100 home interior brands and 27 textile recyclers. They found that by 2030, Syre could provide 3 percent of the eventual market for recycled polyester by 2030, Nobelius said. “There’s plenty of room for more players,” Nobelius said, “and the more that come around the better the textile waste flows will be, and the better business opportunities, including for the sorters and collectors.”

[Join more than 5,000 professionals at Trellis Impact 25 — the center of gravity for doers and leaders focused on action and results, Oct. 28-30, San Jose.]

The post Gap, Target bet on Swedish recycling startup appeared first on Trellis.