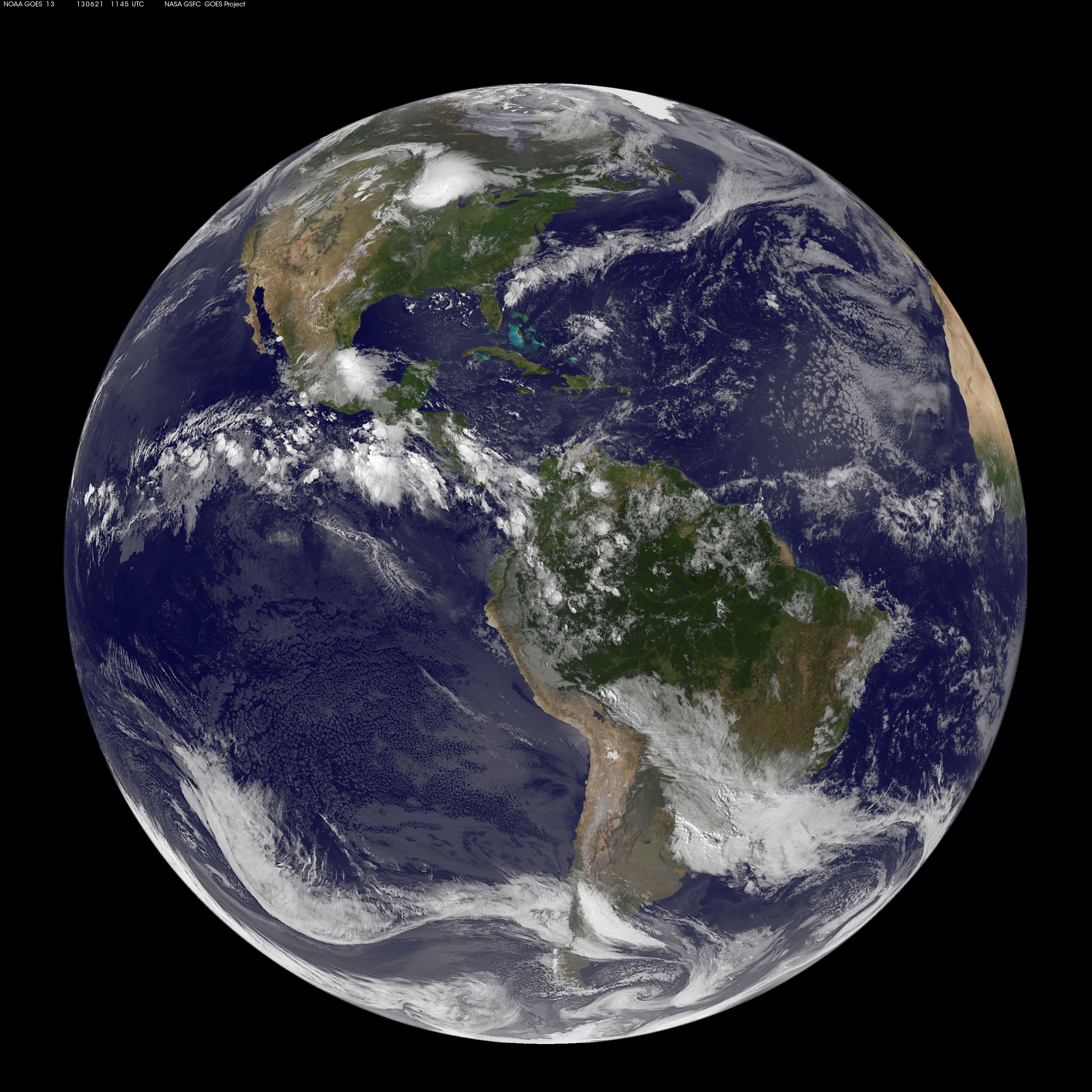

Even more insurers are getting serious about climate change

Risk mitigators can't afford to ignore the problem. But they're own climate plans need to be more transparent. The post Even more insurers are getting serious about climate change appeared first on Trellis.

Insurance is the world’s canary in a coal mine: When the professional risk mitigators identify a looming problem, everyone else takes note. And the U.S. insurance industry has deemed climate change a clear and present financial danger, according to a recent report released by Ceres, a non-profit sustainability advocacy group.

Of the 526 insurance groups participating in the study, 97 percent disclosed their climate-related strategies in 2023, an increase from the 87 percent (of 418 participating groups) surveyed a year earlier. Additionally, the percentage of insurers measuring climate-related risk increased to 76 percent from 62 percent.

The report found that this increase is likely due to many factors, including:

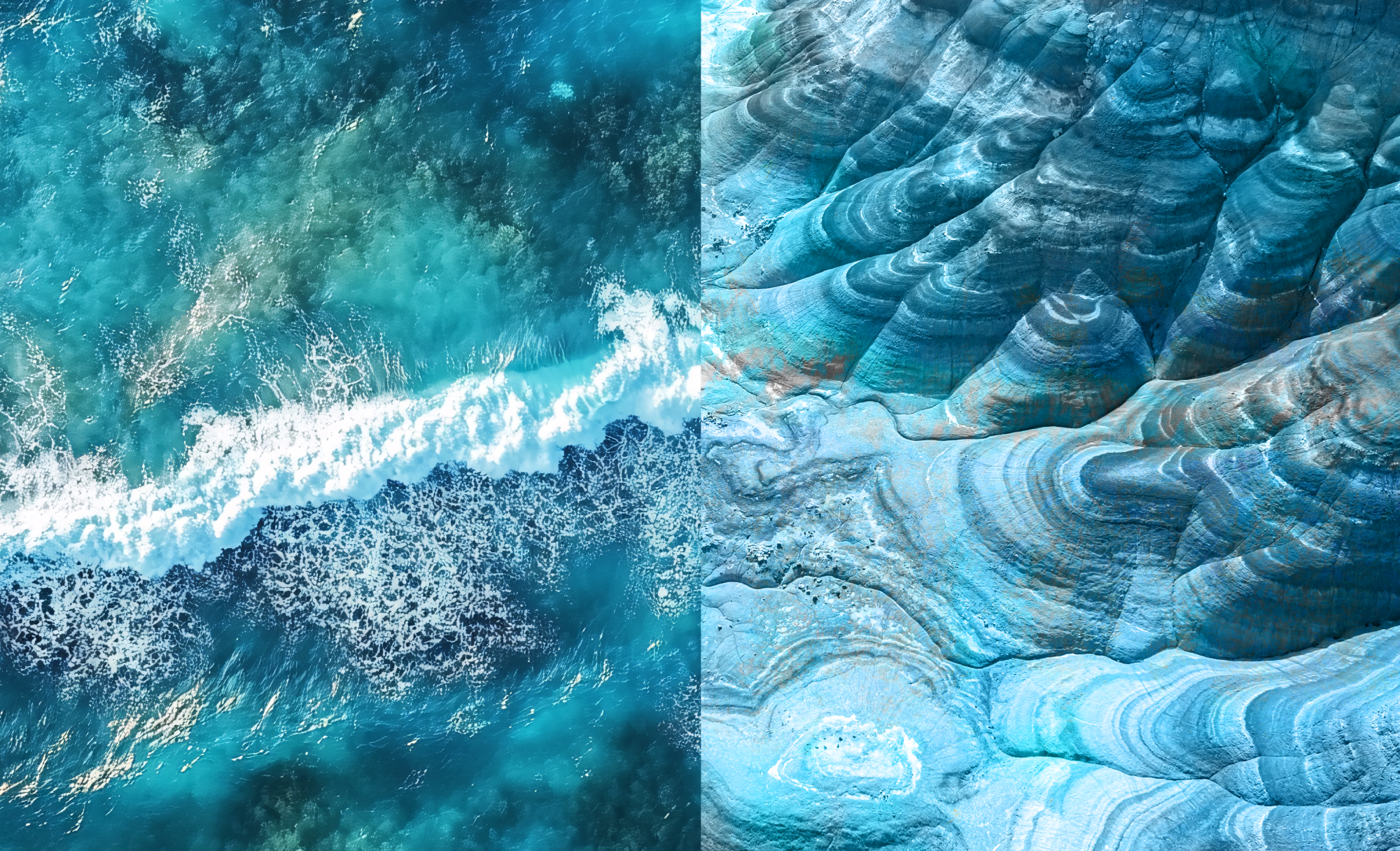

- A projection that the aggregate global financial toll of climate-related disasters will reach $12.5 trillion by 2050

- Weather-related disasters attributable to climate change are expected to increase by 6.5 percent annually going forward, vs. 4.9 percent between 2002-2022

- Rising temperatures causing an abrupt decrease in agricultural yields, with a negative ripple effect on supply chains and regional economics.

But while the percentage of companies disclosing their climate-related strategy reflects the industry’s broad acknowledgement of the problem and its associated risks, the particulars of those plans are often lacking.

“For the third year in a row, we’re seeing plateauing in the response rates for details regarding metrics and targets pillars,” said Jaclyn de Medicci Bruneau, director of insurance for the Ceres Accelerator for Sustainable Capital Market, “We’re still stuck just shy of 30 percent.”

This could be due to several reasons, according to Bruneau. One big one is industry hesitation to record clear and trackable targets that would allow others to hold the insurers accountable. Additionally, smaller insurers may not have the capacity or resources to meet set targets.

Bruneau noted that in August, Ceres will release a companion report that will be “a deep dive on metrics and targets.” This report, she added, will “build out best practices, using examples from carriers that did provide good responses, while also creating a resource for the industry that should help move those numbers up.”

Government’s role

Despite the industry’s general willingness to at least partly disclose climate-related strategies, states like California require even more transparency.

“California’s SB 253 disclosure law will force insurers’ who are doing business in California to really start understanding their transition risk exposure,” said Paul Vozzella, Americas director at Asset Impact. He further noted the Golden State’s leadership in this area: “Many states follow California’s lead when it comes to environmental regulations and disclosures, so we will see how this ‘California effect’ impacts other states’ proposed disclosure regulation laws, especially now under the current federal administration.”

The U.S. Department of Treasury houses the Federal Office of Insurance (FOI), a department dedicated to gathering data that impact the insurance sector and insurance premiums. At least it once was dedicated to that important task.

“With some of the pullbacks being talked about, our country has a potential of becoming less safe because there’s less data,” said Steven Rothstein, managing director of the Ceres accelerator, referring to the Trump administration’s ongoing cuts to programs with even tangential connection to climate change.

“There is a general consensus in the insurance industry that there’s a serious issue here,” concluded Bruneau. “Some would call it a crisis.”

The FOI did not respond to a request for comment.

In the meantime, Rothstein offered Ceres’ 10-Point Plan for the Insurance Industry as a resource.

“The 10-Point Plan is a set of different measures that need to be undertaken both by regulators and carriers, working together to move everything forward,” he said.

The post Even more insurers are getting serious about climate change appeared first on Trellis.