Geoengineering could fight climate change--if scientists can get the public on their side

Apr 7, 2025 0

Estimating the Growth of Electric Vehicles, A 2024 Update on S-Curve Modeling

Apr 8, 2025 0

String Theorists Say Black Holes Are Multidimensional String ‘Supermazes’

Apr 8, 2025 0

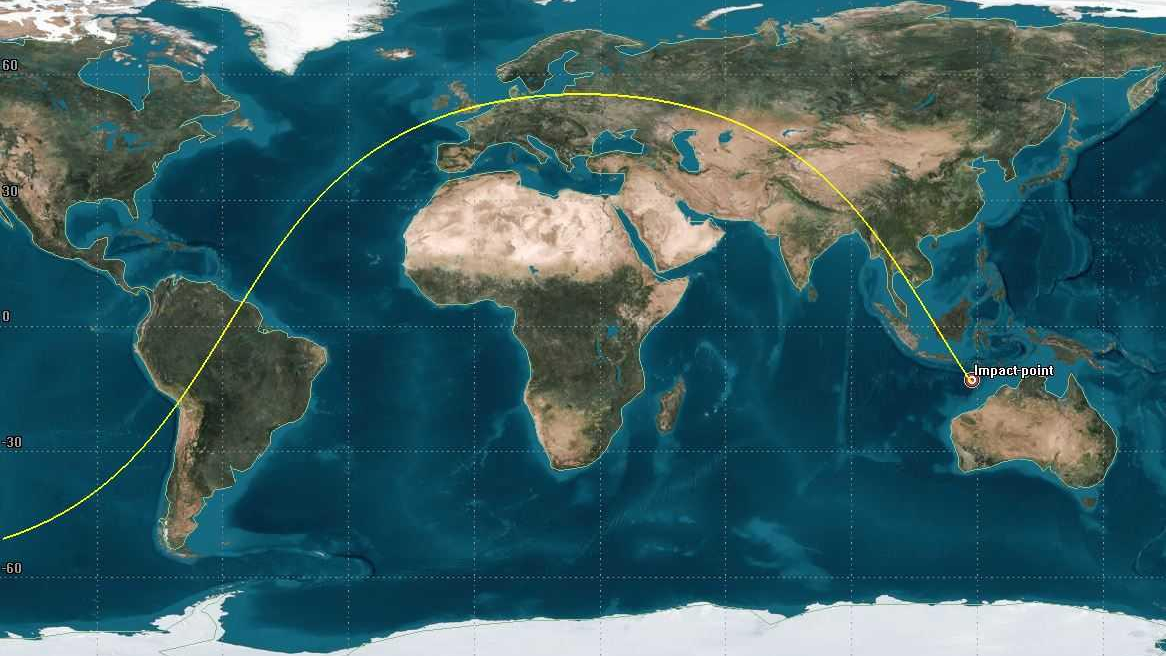

SpaceX launches 27 Starlink satellites on brand-new Falcon 9 rocket, aces Pacific Ocean landing (video)

Apr 8, 2025 0

What Issues Do Healthcare Leaders Want Dr. Oz to Tackle as CMS Administrator?

Apr 7, 2025 0

DOGE ditching tape storage could put data at risk, say experts

Apr 7, 2025 0

No, the dire wolf has not been brought back from extinction

Apr 7, 2025 0

EcoFlow’s First-Ever CSR-Integrated Members’ Festival: A New Paradigm to Bolster Global Disaster Response

Apr 7, 2025 0

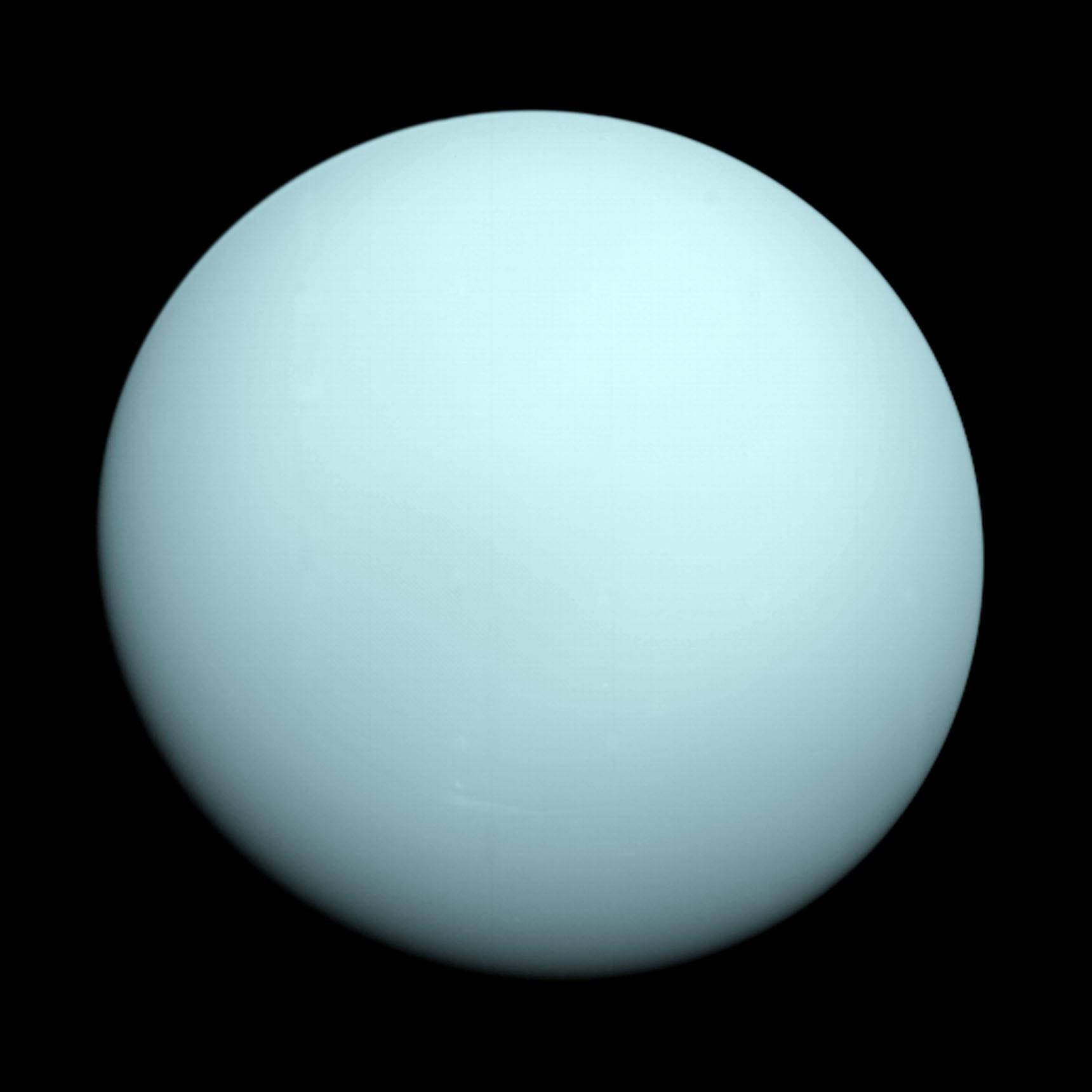

A day on Uranus is actually longer than we thought, Hubble Telescope reveals

Apr 7, 2025 0

Rhythm Pharma Drug Lowers BMI in Rare Form of Obesity Rooted in a Dysregulated Brain Pathway

Apr 7, 2025 0

Health secretary RFK Jr. endorses the MMR vaccine — stoking fury among his supporters

Apr 7, 2025 0

Geoengineering could fight climate change--if scientists can get the public on their side

Apr 7, 2025 0

Estimating the Growth of Electric Vehicles, A 2024 Update on S-Curve Modeling

Apr 8, 2025 0

String Theorists Say Black Holes Are Multidimensional String ‘Supermazes’

Apr 8, 2025 0

SpaceX launches 27 Starlink satellites on brand-new Falcon 9 rocket, aces Pacific Ocean landing (video)

Apr 8, 2025 0

What Issues Do Healthcare Leaders Want Dr. Oz to Tackle as CMS Administrator?

Apr 7, 2025 0

DOGE ditching tape storage could put data at risk, say experts

Apr 7, 2025 0

No, the dire wolf has not been brought back from extinction

Apr 7, 2025 0

EcoFlow’s First-Ever CSR-Integrated Members’ Festival: A New Paradigm to Bolster Global Disaster Response

Apr 7, 2025 0

A day on Uranus is actually longer than we thought, Hubble Telescope reveals

Apr 7, 2025 0

Rhythm Pharma Drug Lowers BMI in Rare Form of Obesity Rooted in a Dysregulated Brain Pathway

Apr 7, 2025 0

Health secretary RFK Jr. endorses the MMR vaccine — stoking fury among his supporters

Apr 7, 2025 0

Geoengineering could fight climate change--if scientists can get the public on their side

Apr 7, 2025 0

![The breaking news round-up: Decagear launches today, Pimax announces new headsets, and more! [APRIL FOOL’S]](https://i0.wp.com/skarredghost.com/wp-content/uploads/2025/03/lawk_glasses_handson.jpg?fit=1366%2C1025&ssl=1)