Hospital Margins Plateau in February Amidst Rising Expenses and Mixed Patient Demand

What You Should Know: – New data from Strata Decision Technology indicates that operating margin performance for health systems across the nation plateaued in February, as rising expenses continue to limit growth. – The new data finds individual hospitals saw increases in some key performance metrics compared to the previous year, overall trends in hospital ... Read More

What You Should Know:

– New data from Strata Decision Technology indicates that operating margin performance for health systems across the nation plateaued in February, as rising expenses continue to limit growth.

– The new data finds individual hospitals saw increases in some key performance metrics compared to the previous year, overall trends in hospital margins were mixed, and patient demand decreased across most measures.

Operating Margins Remain Stagnant

The median year-to-date (YTD) health system operating margin was 1.0% for February 2025, unchanged from January’s 1.0% but down from 2.1% in December 2024.

Mixed Trends in Hospital Margins

- The median change in hospital operating margin increased 1.4 percentage points from February 2024 to February 2025.

- However, it decreased 1.4 percentage points from January to February 2025.

- The median operating earnings before interest, taxes, depreciation, and amortization (EBITDA) margin rose 1.1 percentage points year over year (YOY).

- However, it decreased 1.2 percentage points month over month.

Rising Expenses Continue to Pressure Hospitals

Hospitals continue to struggle with increasing expenses.

- Purchased services had the largest expense increase for the month, at 8.7% YOY.

- Supply expense rose 6.7% YOY.

- Drugs expense increased 5.4% YOY.

- Total non-labor expense increased by 5.7% from February 2024 to February 2025.

- Total labor expense rose 2.2% YOY.

- Total expense was up 4.2% YOY.

Some Relief Month Over Month

Hospitals did experience some relief month over month:

- Total expense decreased 4.9%.

- Total labor expense dropped 7.1%.

- Total non-labor expense decreased 3.1% from January to February 2025.

Decreased Patient Demand

Patient demand decreased across most metrics and measures in February.

- Emergency visits had the biggest YOY decrease, with patient volumes down 6.1%.

- Observation visits were down 4.6% YOY.

- Outpatient visits decreased 2.7% YOY.

- Inpatient admissions were the only metric to see an increase, at 1.5% YOY.

- Month over month, emergency visits dropped 14.8%.

- Observation visits were down 11.1%.

- Inpatient admissions decreased 9.3%.

- Outpatient visits were down 6.9%.

Increased Patient Volumes in Some Service Lines

Patient volumes increased across some service lines.

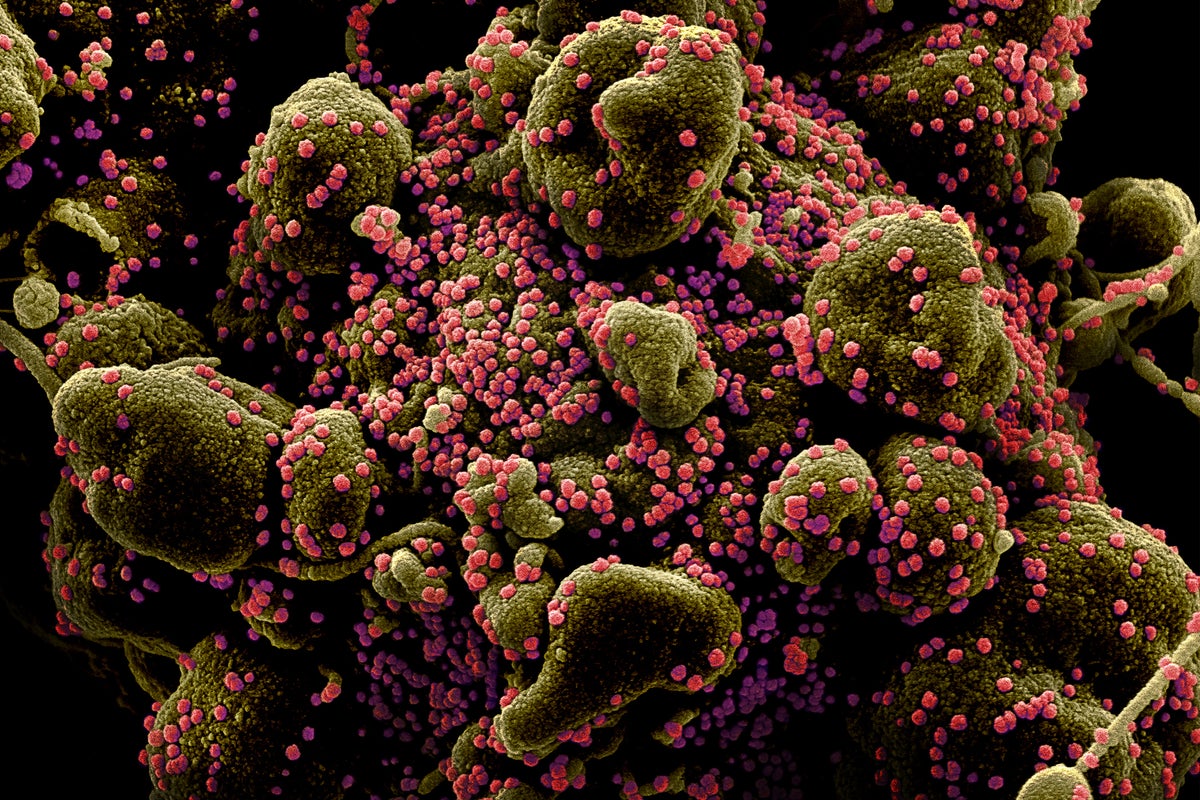

- Infectious disease had the biggest increase, at 15.2% YOY.

- Nephrology increased 7.5% YOY.

Revenue Trends

Gross inpatient hospital revenues rose faster than outpatient revenues for the month.

- Hospitals saw a 22nd month of YOY increases across gross operating, inpatient, and outpatient revenues.

- Inpatient revenue rose 7.4% from February 2024 to February 2025.

- Outpatient revenue was up 4.4%.

- Gross operating revenue increased 5.1%.

“Expense increases continue to exert pressure on our nation’s hospitals and health systems in the early months of 2025,” said Steve Wasson, chief data and intelligence officer at Strata Decision Technology. “While expenses are increasing across all categories, non-labor expense increases have outpaced labor expense growth for the past three months. Reining in these increases will be a primary focus for healthcare leaders as we head into the second quarter of the year.”

.jpg?#)