Hèrmes, Stella McCartney and Calvin Klein embrace a leather alternative: fungus

Luxury brands are partnering with startups on biodegradable leather alternatives. Here's how their purses, shoes and couches are inching toward the mainstream. The post Hèrmes, Stella McCartney and Calvin Klein embrace a leather alternative: fungus appeared first on Trellis.

- Material made from the “roots” of mushrooms mimic the feel and durability of leather.

- Startups like MycoWorks, Hydefy and Ecovative have each raised nine figures.

- Sustainability advocates are pushing mainstream apparel giants to provide even more support for biodegradable options.

Leather remains the go-to material for high-end purses, couches and car interiors. Its petroleum imitation, “pleather,” serves mortals on a budget.

But fungus-focused biotech startups want the world to consider a third option. They are brewing materials that mimic the feel and durability of leather, without the grim costs to nature from exploiting animals or fossil fuels. The key ingredient is mycelium, found in the thread-like “roots” of mushrooms.

More brands are working with these younger companies to test the biomaterials and gauge consumer interest for purses, apparel, shoes and furniture. These partnerships include Mycoworks with Hermès, Hydefy with Stella McCartney and Ecovative with Calvin Klein parent PVH Corp.

The three startups share several things in common. Each has raised nine figures in funding and advertises a leather-like look and feel for plastic-free, biodegradable products on the brink of reaching commercial scale.

The mycelium “leather” market, which reached $12 million in 2024, will soar up to $336 million by 2033, according to research by Market Intelligence.

“There’s a lot of energy in this space right now,” said Katrin Ley, managing director of Fashion for Good, an Amsterdam nonprofit that seeks to accelerate sustainable materials. “We’re seeing continued interest in exploring alternative materials — especially among brands looking to meet ambitious sustainability goals. Some are deepening their R&D efforts; others are partnering directly with innovators to co-develop products.”

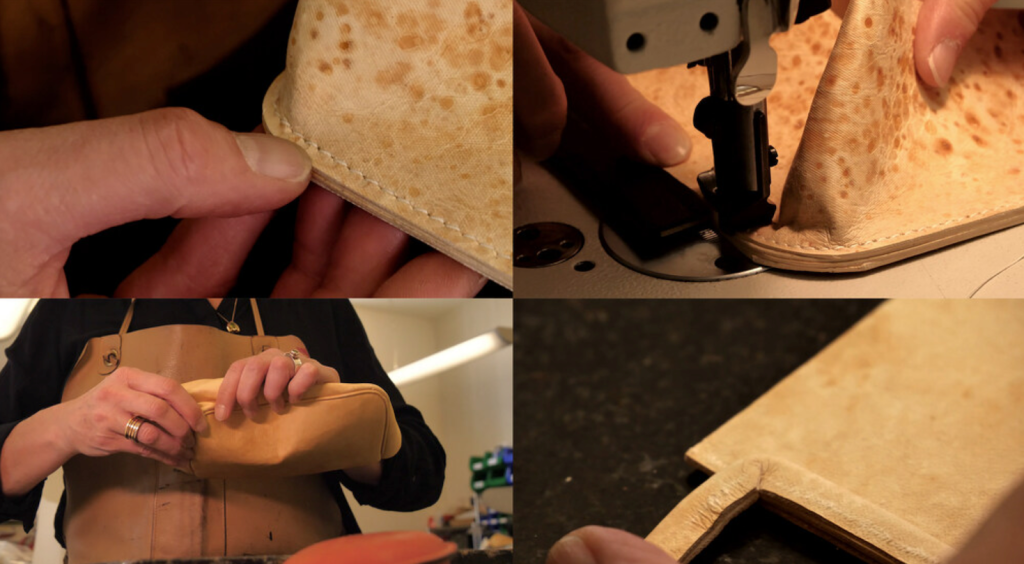

Mushrooms in action

Mycelium companies insist their creations are maturing past the “gee-whiz” phase and readying to scale. Industry experts cite MycoWorks of Emeryville, California, as the most advanced player. With roughly 250 employees, it has attracted more than $187 million in capital. MycoWorks’ 136,000 square foot plant in Union, South Carolina, uses artificial intelligence and robotics to automate most production. The factory is in a forested region close to sources of sawdust, a main input. The company ships its material for tanning to Igualada, Spain, which has a long heritage of tanning hides.

MycoWorks’ biomaterial, Reishi, recently debuted in a Ligne Roset couch and on the inner door panels of a concept electric General Motors Cadillac. The company’s Fine Mycelium technology was included in an Hermès travel bag in 2022.

Reishi meets or exceeds furniture industry benchmarks for flexibility, abrasion resistance, colorfastness and aging, according to MycoWorks. And for every 11 square feet of material made, only 6 pounds of carbon dioxide or its equivalent are produced — far less than is the case with animal and synthetic leathers.

“MycoWorks has focused on refining the material’s unique properties rather than attempting to imitate leather,” said Fred Martel, the company’s senior vice president of sales and business development. “We are building enduring relationships with partners ready to scale with us—those who recognize that Reishi is not an alternative material, but a new category altogether.”

Chicago startup Hydefy also promotes its biomaterial as being in a class of its own. Its version, called Fy, appears in a purse that Stella McCartney will flaunt in its summer runway show.

Hydefy is also working with several other large apparel and footwear brands.

The company’s work emerged from NASA-supported research that found fungi flourishing around the acidic geothermal hot springs of Yellowstone National Park. The fungi grows in three days in a plant in the former meatpacking district of Chicago, according to Hydefy.

“We set out on this mission because we wanted to give consumers options,” said Rachel Lee, head of business at Hydefy. “Ultimately, we just want consumers to have alternatives to animal and synthetic leathers to reduce reliance on petroleum.”

Hydefy has used liquid air fermentation technology to multiply its fungi. Now, though, it’s moving toward submerged fermentation, a process similar to brewing beer. The company dries and combines the mycelium with crop waste, such as sugarcane husks, to create blocks of material. Next, laminated vinyl flooring machines, customized by the company, churn out sheets of Fy. Hydefy’s use of common polymer industry equipment in an uncommon way offers a scalability advantage, according to Lee.

Hydefy claims to meet brands’ leather-based performance expectations. In any event, some big names are buying what the company is selling. “I am constantly exploring plant and fungi-based, regenerative alternatives that do not harm animals and heal Mother Earth,” Stella McCartney said in a March 31 press statement. “Harmonious to this philosophy, the innovators behind Hydefy are developing materials with fresh thinking and a focus on sustainability.”

This may sound familiar to longtime observers of next-gen materials. Back in 2016, another Stella McCartney bag featured Mylo, a mycelium material cultivated by startup Bolt Threads. However, even after raising more than $300 million, the company paused its fungus-fashion efforts in 2023, citing high costs.

How to scale?

Initial high overhead, infrastructure limitations and supply chain immaturity all contribute to the harsh realities of scaling new materials. That’s why the innovators working with Fashion for Good are taking a long-term, strategic approach, according to Ley. “By working together with brands, suppliers and investors, they’re collectively mitigating financial risks and building the infrastructure necessary to scale sustainably, making sure that the materials are actually market ready and can meet the industry’s quality standards.”

For the moment, though, mycelium materials best suit high-end products rather than mass market goods, according to Tiffany Hua, an analyst at Lux Research in Boston.

The biotech developers rely heavily on co-development partnerships with brands to overcome the strength, flex resistance and durability shortcomings of the new materials, Hua added. In addition, the fermentation process is resource-intensive and finicky. “Even with efforts to automate and integrate robotics, as MycoWorks is attempting, development timelines remain slow and expensive,” she said.

Another mycelium player, Ecovative, announced March 27 that it was receiving $11 million in funding. The Green Island, New York, venture has raised a total of $120 million. Last year it completed a three-year collaboration with Fashion for Good, exploring how its Forager material could function in products created by Bestseller, PVH Corp. and others.

“That pilot helped us better understand the practical challenges of scaling mycelium leather,” Ley said. “It gave the innovators feedback from real brand use cases — how the material performs, how it fits into existing processes and where the friction points are.”

That said, sustainability experts argue that the apparel establishment needs to do more to provide stability and growth to biomaterials innovators.

Cynthia Power, a fashion circularity expert and owner of Molte Volte Consulting in New York, says that brands and retailers should ink long-term investments with startups. “It is rarely helpful to a material innovator to get a brand to use their material for one season and then drop off,” she explained. “If anything, that can be damaging to their smaller and more fragile company ecosystem.”

Power added that fashion businesses should also identify the largest environmental and social “offenders” among their materials, then support the startups formulating less-harmful alternatives. “Most of these startups are waiting for their phone to ring with a big order or big name brand to sign an off-take agreement,” she said.

The post Hèrmes, Stella McCartney and Calvin Klein embrace a leather alternative: fungus appeared first on Trellis.