AstraZeneca’s $130 million biomethane plant is a model for high-emitting industries

Its new biomethane plant is the U.K.’s first unsubsidised biomethane plant dedicated to serving the life sciences sector The post AstraZeneca’s $130 million biomethane plant is a model for high-emitting industries appeared first on Trellis.

Key takeaways

- The plant is expected to supply 100 gigawatt hours (GWh) of renewable gas annually to AstraZeneca’s plants in the U.K.

- It was built by Future Biogas with a 15-year, $130 million offtake agreement from AstraZeneca.

- It operates without subsidies and uses dedicated energy crops, not waste materials.

In an industry better known for pioneering new medicines than renewable energy, AstraZeneca has taken a significant step: it’s now fuelling its U.K. operations with “green gas” from a purpose-built biomethane plant.

The facility, located at Gonerby Moor in Lincolnshire, east England, and operated by Future Biogas, is the UK’s first unsubsidised biomethane plant dedicated to serving the life sciences sector.

It also represents a serious commitment to decarbonization — and a template for other high-emitting industries to follow.

“We’ve been on a journey in the UK for many years to reduce our carbon footprint,” Liz Chatwin, vice president of sustainability and global safety, health and environment at AstraZeneca, told Trellis. “The missing piece of the puzzle was our source of heat power.”

That gap has now been filled by biomethane produced from locally grown energy crops through anaerobic digestion, then injected into the national gas grid. Biomethane is considered carbon neutral because the carbon released during digestion and burning is first absorbed by the plants as they grow.

The plant is expected to supply 100 gigawatt hours (GWh) of renewable gas annually to AstraZeneca’s sites in Macclesfield, Cambridge, Luton and Speke — enough to meet the heat demand of over 8,000 UK homes.

The plant, built with a 15-year, £100 million ($130 million) commitment from the pharmaceutical giant, completes AstraZeneca’s goal of having all its UK R&D and manufacturing powered by 100 percent renewable energy. AstraZeneca will take all of the plant’s generation capacity for at least the next 15 years.

Why biomethane is a good fit for the life sciences

The pharmaceutical industry has a big emissions problem. According to a 2019 study, pharma companies generate over 48 tonnes of CO₂ equivalent per $1 million of revenue — around 55 percent more than the emissions intensity of the automotive sector.

In all, roughly 4.5 percent of global emissions are attributed to the healthcare sector, with the bulk of these attributed to pharmaceutical procurement, production and use.

So why turn to biomethane?

“There’s a lot of processes in pharmaceuticals that are hard to electrify because they require high heat, like raising steam,” said Philipp Lukas, CEO of Future Biogas. “Biomethane is a drop-in fuel for that. It’s a one-for-one substitute, meaning all the infrastructure to deliver and use it is already there.

“If a company wants to decarbonize quickly whilst on that journey to electrification, then operating on biomethane can provide a solution in 12 to 18 months.”

Future-proof power supplies

Beyond convenience, the project also aims to be self-sustaining. Unlike many earlier biogas schemes, this plant operates without subsidies and uses dedicated energy crops — not waste materials.

That distinction matters. While animal manure can be a valuable feedstock for biomethane, Lukas noted it comes with the complication of possibly promoting intensive livestock farming. “AstraZeneca wanted something where they could see the sustainability all the way through,” he said.

Instead, crops are grown locally under five-year contracts that help farmers invest in regenerative practices, such as diversified crop rotation, reduced fertilizer use and improved soil health.

“The exciting thing about this is that you can support food production, not only boosting resilience but also reducing fossil fuel inputs on the farm,” Lukas said.

Cut carbon, and capture it too

The Gonerby Moor site doesn’t stop at producing biomethane: It also includes carbon capture technology that removes CO₂ from the fermentation process — CO₂ that the energy crops had absorbed from the atmosphere a season earlier.

To begin with, the captured gas will be used in industry — for greenhouses, soft drink carbonization and the like – but longer-term, AstraZeneca hopes to send it for permanent geological storage through Norway’s Northern Lights project, turning the plant into a carbon-negative operation.

According to AstraZeneca, the partnership with Future Biogas will reduce its emissions by 20,000 tonnes of CO₂ equivalent per year. A major retrofit of its Macclesfield combined heat and power (CHP) plant will save another 16,000 tonnes.

All this is part of the company’s Ambition Zero Carbon programme, which aims to halve emissions across its full value chain by 2030 and reach science-based net zero by 2045.

A model for others?

It’s a bold move — but is it replicable? Could other pharmaceutical or life science companies adopt a similar approach?

“The Moor Bioenergy plant serves as an excellent blueprint for other companies in our sector.” said Chatwin. “By utilizing locally sourced bioenergy crops and innovative carbon capture technologies, we are demonstrating how energy efficiency and sustainability can be integrated into manufacturing and research processes.”

“The unsubsidized nature of this project highlights the wider role of corporations in helping to build up renewable energy infrastructure,” said Amy Booth, a researcher at the University of Oxford who studies the environmental impact of health systems. “It would be nice to see others in the industry taking that up too.”

AstraZeneca is not only buying into biomethane — it has also cut its energy demand. The original estimate was that the company would need 350 GWh of electricity per year. After a company-wide push on energy efficiency — upgrading equipment, improving insulation and switching to electric systems where possible — that figure dropped to 100 GWh.

“Always follow the maxim: use less, and pay more,” said Lukas. “The less energy you need, the more you can afford to invest in the sustainable options.”

The company is planning to invest in other renewable energy projects, including a partnership in the US with Vanguard Reneawables to deliver biomethane to all of its sites by the end of 2026.

Other companies are also exploring biomethane. French pharmaceutical company Sanofi recently announced a purchase agreement to decarbonize 56 percent of its gas consumption in France. The 6-year deal covers 1.3 TWh of power, along with an additional 10-year contract covering 110 GWh to decarbonize Sanofi’s site in Lyon.

GSK, another pharmaceutical behemoth, is instead looking to solar. The company agreed a virtual power purchase agreement in 2024 to supply 50 percent of its European operations with solar power for 12 years using sites in Spain.

Challenges ahead

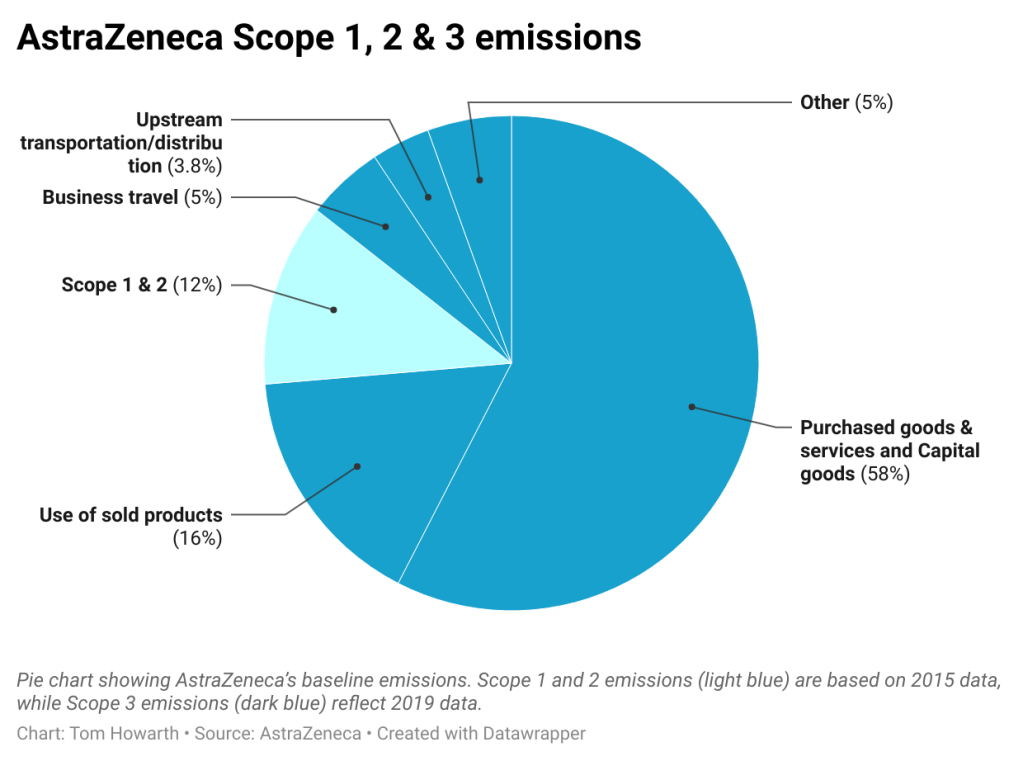

Energy procurement alone will not significantly shrink AstraZeneca’s footprint. Upwards of 90 percent of the pharmaceutical industry’s emissions are Scope 3, stemming from complex, global supply chains that encompass everything from packaging and logistics to the end use of products, all operating under varying regulations across different countries.

“I would congratulate [AstraZeneca] on this, but to put it into perspective, Scope 2 is a small part of the overall emissions challenge,” said Dr. Jagjit Singh Srai, head of the Centre for International Manufacturing at the University of Cambridge. “Scope 1 is something you can really control — that’s your energy efficiency, et cetera. And I think the next most controllable element is your energy sourcing. They will be looking at Scope 3 also and addressing that directly.”

AstraZeneca has its eyes upon the Scope 3 challenge, as well.

More than two thirds of Astra Zeneca’s suppliers have committed to science-based targets, Chatwin said. The company is also a founding member of Energize — a collaboration between Schneider Electric and 19 global pharma companies to “facilitate renewable power at scale for our suppliers.

“While there is still more to be done, we’re making progress, and it is indeed a shared challenge.”

The post AstraZeneca’s $130 million biomethane plant is a model for high-emitting industries appeared first on Trellis.

![The breaking news round-up: Decagear launches today, Pimax announces new headsets, and more! [APRIL FOOL’S]](https://i0.wp.com/skarredghost.com/wp-content/uploads/2025/03/lawk_glasses_handson.jpg?fit=1366%2C1025&ssl=1)