Tariffs threaten Canadian aluminum critical to U.S. energy transition

Opponents include the U.S. aluminum industry and organized labor. The post Tariffs threaten Canadian aluminum critical to U.S. energy transition appeared first on Trellis.

The steep tariffs enacted by President Donald Trump on imports from Canada will have broad effects across the U.S. economy, including a critical raw material: aluminum.

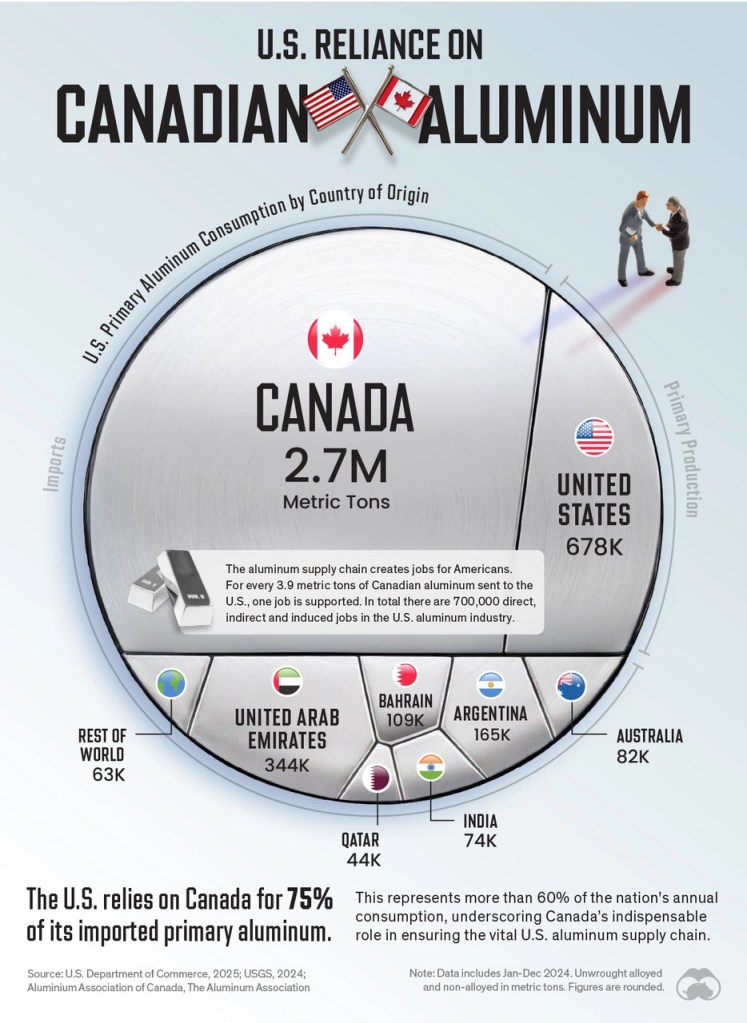

The American aluminum industry has been in decline for decades, The metal is critical to the energy transition — used in applications including EVs, solar panels, the power grid and wind turbines — and three-fifths of U.S. aluminum supplies come from Canada.

Trump said on March 11 that he would double the tariffs, set to take effect on March 12. He backed down after Ontario rescinded planned price hikes on electricity exports to the U.S. But aluminum and steel imports will still be 25 percent more expensive.

Increasing the price of imports may increase domestic production, but it will definitely make it difficult for U.S. manufacturers to compete globally, raise local prices for consumers and hamper the effort to build a domestic manufacturing base for clean energy infrastructure, say most economists.

“We must distinguish between trusted trade partners, like Canada, and those who are seeking to undercut our industries as they work to dominate the global market,” said United Steelworkers International President David McCall in a statement. “Canada is not the problem.”

Aluminum ally

In 1980, the U.S. produced 4.7 million metric tons of primary aluminum, 30 percent of the world’s production. Today, U.S. output has dwindled to four surviving smelters producing just 1.1 percent of the world’s aluminum, around 700,000 metric tons a year. High energy prices and low-cost foreign production, primarily in China, India and Russia, are largely to blame.

The U.S. uses about 5 million metric tons of aluminum per year and sources around 3 million metric tons of that from Canada.

Meanwhile, global demand is rising sharply. According to a study by researchers at Dartmouth and Princeton, domestic aluminum demand from solar and wind power alone is expected to increase to 7.8 million metric tons a year by 2035.

The shift to electric vehicles is driving demand as well: EVs require 85 percent more aluminum per vehicle than gas-powered cars. The lightweight metal helps offset heavy lithium-ion batteries.

Aluminum production is also responsible for about 2-3 percent of global emissions, 81 percent of which come from electricity used during smelting.

“In the U.S., the problem is all these smelters are tied to fossil fuels,” said Stephen Snudden, professor of economics at Wilfred Laurier University in Waterloo, Ontario. “It creates a lot of profit uncertainty because the price of fossil fuels is fluctuating rapidly.”

Canadian smelters, on the other hand, run almost entirely on hydroelectric power — a reliable, affordable and low-carbon source of electricity.

“If you wanted to replace what we ship to the U.S. on a yearly basis with an equivalent carbon footprint, you would need to build six Hoover Dams,” said Jean Simard, president and CEO of the Aluminum Association of Canada.

Canada, the world’s fourth-largest aluminum producer, sends close to 90 percent of its output to the U.S.

Seeking clean aluminum

“You basically have two ways of protecting the aluminum industry in the U.S.,” said Snudden. “One is to provide cheap, sustainable electricity. The other is to protect revenue and increase the domestic price of aluminum.”

Those pathways mirror the distinct approaches taken by former President Joe Biden and Trump.

The Inflation Reduction Act provided $500 million for the creation of a new aluminum smelter that would run on clean energy. Dubbed the “Green Smelter,” it would double domestic aluminum production while cutting emissions by 75 percent compared to other American smelters. It would be the first aluminum smelter built in the U.S. in 45 years.

The Trump administration’s recent funding cuts put the future of the new smelter up in the air, but no official decision has been made. The DOE did not respond to a request for comment and Century Aluminum, contracted for the project, declined to comment.

“We certainly have the potential to meet the needs of the industry, and more,” said Evan Gillespie, partner at Industrious Labs, an organization advocating for the decarbonization of heavy industry. “The frustrating thing is that a lot of those pieces were coming into place via the Biden administration.”

Trump’s tariffs gamble

With many clean energy projects losing federal funding under Trump, what chance do tariffs have to save the industry?

During Trump’s first term, he levied a 10 percent tariff on aluminum imports. The tariffs were removed the following year.

“U.S. aluminum production rose 40 percent over the next three years after Trump was first elected,” said Snudden. “But the manufacturing industries in the U.S. did suffer last time those tariffs were implemented.”

The White House released a fact sheet claiming that the 2018 tariffs “strengthened the economy” and “reduced imports from China.”

A new report from the Coalition for a Prosperous America, a Washington, D.C.-based think tank that advocates protectionist trade policies, argues that the new tariffs “are essential for national security, economic stability and the revitalization of America’s domestic steel and aluminum industries, which have been severely undermined by global overcapacity and foreign subsidies — especially from China.”

Other analyses differ. A fall 2019 paper in the Journal of Economic Perspectives, authored by an official of the Federal Reserve Bank of New York and economists from Princeton and Columbia, found that the 2018 tariffs cost American consumers and businesses an additional $3.2 billion per month because “much of the tariffs were passed on almost immediately to U.S. importers and consumers.”

The costs of trade wars “are quite large relative to optimistic estimates of any gains that are likely to be achieved,” the study concluded.

Alternative sources

Opponents of the tariffs on Canadian imports include the U.S. aluminum industry.

“For our industry’s growth, and for national security, we must maintain tariff-free access to aluminum from Canada,” said Aluminum Association President and CEO Charles Johnson.

The association welcomes presidential actions to limit Chinese aluminum flooding the American market, but cautions against launching a trade war with Canada.

“In what way does it make sense to move away from relying on Canada so much for aluminum?” Gillespie asked. “I don’t think it does. It’s a core ally of ours who provides low-cost aluminum.”

While tariffs may prop up American industry in the short term, deploying them as a long-term solution may make Canadian producers turn their attention elsewhere.

“Not having to bear a [50] percent tariff may make Europe a more interesting proposition,” said Simard. “The shipping routes are already there. Most of our plants are coastal and have seaborne supply chains.”

The post Tariffs threaten Canadian aluminum critical to U.S. energy transition appeared first on Trellis.

.jpg)