Not All Healthcare Claims Data is Created Equal – A Buyer’s Guide

When you look at the future of healthcare, there’s no future vision that doesn’t include AI and analytics that improves the care given to patients and the healthcare business processes that impact healthcare organizations. At the core of every AI and analytics effort is having good, high quality data that you can trust. One of […]

When you look at the future of healthcare, there’s no future vision that doesn’t include AI and analytics that improves the care given to patients and the healthcare business processes that impact healthcare organizations. At the core of every AI and analytics effort is having good, high quality data that you can trust. One of the most common forms of data used in healthcare is claims data. The nice thing is that claims data is pretty accessible. However, when you start to dig into the details of claims data, there is a lot of nuance around the quality and accessibility of this data for healthcare organizations.

This was highlighted really well to me in this Market Data Analytics Buyer’s Guide that was created by LexisNexis® Risk Solutions. The guide dives deep into a lot of the nuances related to purchasing and incorporating claims data into your solution. Of course, it starts off making sure you understand your goals for the project. Does the data even help you achieve that goal? Having a clear goal can make sure that you end up with the right data that will actually help you achieve the outcome you desire. Sounds like common sense, but I hear all the time about people trying to leverage data that doesn’t actually produce the result they want. Or the data isn’t available in an accessible format that allows you to produce the desired result.

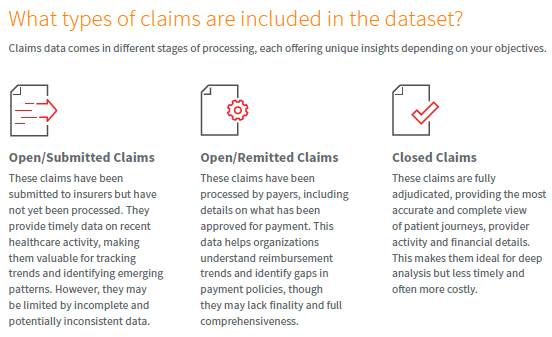

The buyer’s guide also suggests that there are four key considerations when selecting claims data: types of claims, coverage, linking and deduplication, and interface delivery. Each of these considerations really are key to being able to ensure the data’s quality and usability are sufficient for the problem you are working to solve. Looking at these considerations, I was particularly interested in the one about types of claims. Here’s a little preview of that point which you can find in the full Market Data Analytics Buyers Guide:

This perfectly highlights the important nuances of claims data. Far too many people just say, give me all the claims data without understanding that there are different types of claims data. Do you want all open/submitted claims or do you just want closed claims? Most people’s response is “Give me all of the data”, but you have to remember that sometimes getting all of the data can be cost prohibitive. Plus, getting all claims data can create added overhead for development teams who have to then sift through the data. In many cases, it’s much better to get already filtered data that is designed to solve the problem you’re trying to solve. You can always add more data later if needed.

In the example above, if you are working on a forecasting project where you’re looking at future trends, then the Open/Submitted Claims data may be more than sufficient. However, if you’re looking to do a very specific analysis of things like cost patterns or patient outcomes, then Closed Claims data is much more dependable and useful. Those are just a few examples, but you get the idea. This goes back to where we started. When you know what outcome you are working to achieve, then you can make better choices around what data will serve your goals best.

Of course, there are a lot more aspects to claims data which you can learn about in the buyer’s guide. Is the data comprehensive? How clean and connected is the data and is there a lot of duplicates? How accessible is the data? Can I integrate the data with my existing system and what kind of support is offered?

I could offer a lot more questions you should be asking your healthcare claims data provider, but it’s much easier if you go download the Market Data Analytics Buyers Guide where they have a great sheet called “10 Questions to Ask When Choosing the Right Claims Data Solution.” That list offers the detailed questions you need when evaluting a claims data provider.

Obviously, there is a lot of nuance to healthcare data and specifically claims data. Making sure your organization is getting the right data in the right format so you can use it to create amazing outcomes for your users is key. This Buyer’s Guide will help you navigate the nuances of claims data to make sure you are doing it the best way possible.

What has been your experience with claims data? What are some of the nuances you have experienced with data like claims data? Let us know on social media.

![The breaking news round-up: Decagear launches today, Pimax announces new headsets, and more! [APRIL FOOL’S]](https://i0.wp.com/skarredghost.com/wp-content/uploads/2025/03/lawk_glasses_handson.jpg?fit=1366%2C1025&ssl=1)