How Microsoft’s deal with a low-carbon cement startup will cut its data center emissions

The technology giant is using a new environmental attribute certificate generated by production of low-carbon steel, cement and concrete. The post How Microsoft’s deal with a low-carbon cement startup will cut its data center emissions appeared first on Trellis.

Microsoft, which usually leaves buying construction materials to its contractors, has signed a long-term contract to buy low-carbon cement by startup Sublime Systems. It will use a new form of environmental credits related to that purchase to claim emissions reductions related to data center construction.

Under the deal, announced May 22, Microsoft will claim 622,500 metric tons of emissions reductions over a six-to-nine-year period against its Scope 3 footprint — which accounted for 96.5 percent of the technology company’s total footprint in its 2023 fiscal year.

For perspective, Microsoft used 605,000 carbon credits that year to make its carbon neutral claim. It has also purchased credits for close to 20 million tons of carbon removal.

Microsoft plans to use Sublime’s cement in data centers, infrastructure and offices wherever geographically possible. Most cement is used within a few hundred miles of where it is produced.

Microsoft’s footprint rose 31 percent between 2020 and 2024, largely because of data center expansion. Concrete and steel are carbon-intensive materials that together contribute 13 percent of global carbon dioxide emissions. With much ado being made about the huge energy appetite of data centers that fuel artificial intelligence, Amazon, Google and Microsoft are all seeking ways to address their construction-related emissions.

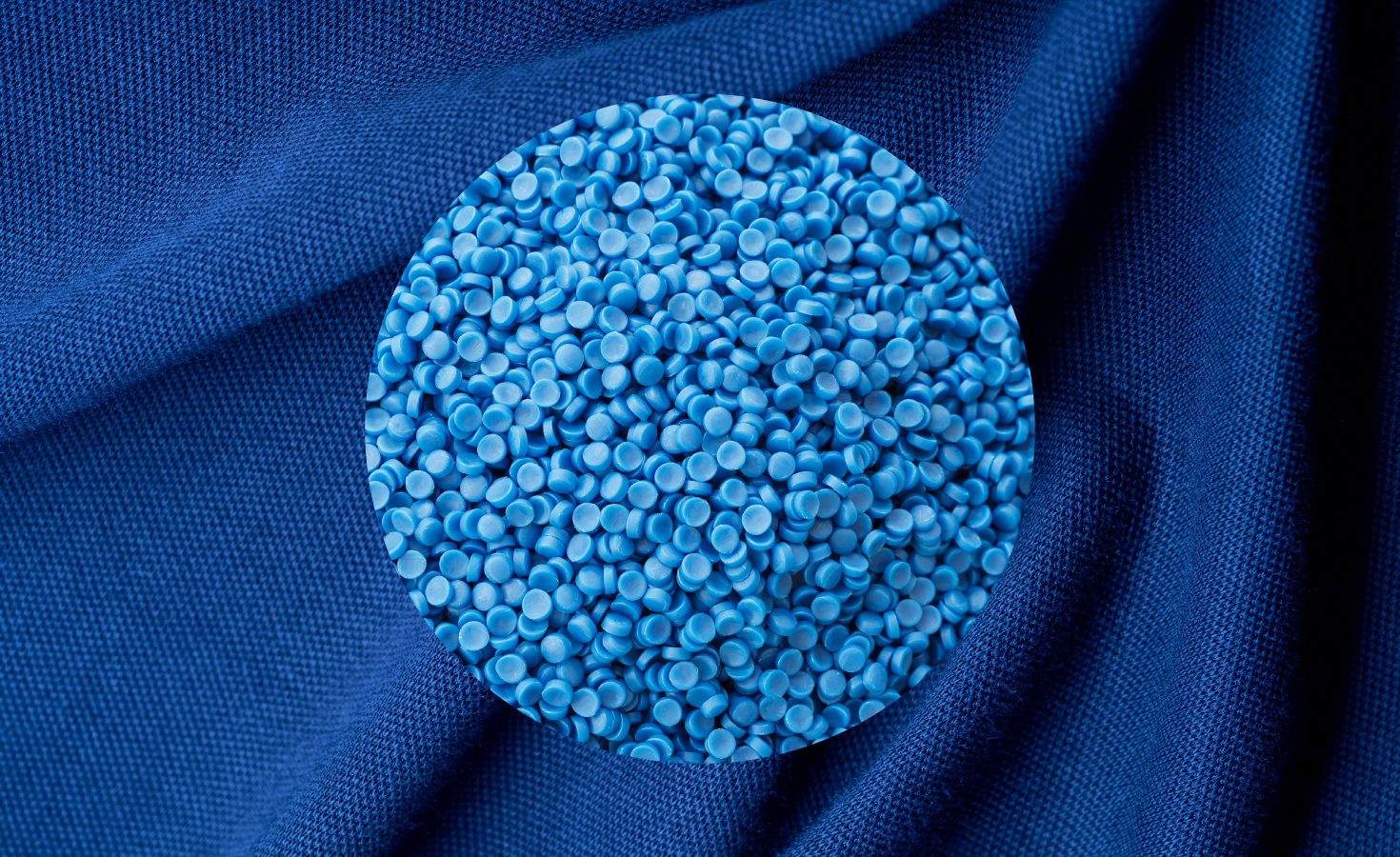

Sublime uses an electrochemical process instead of a combustion-driven kiln to manufacture a replacement for ordinary portland cement. The company, spun out of research at the Massachusetts Institute of Technology, has raised $200 million from venture capital firms including The Engine, Lowercarbon Capital and Energy Impact Partners. It also was awarded $87 million by the Department of Energy in 2024, funding that so far has not been affected by the Trump administration’s shifting priorities.

“We see a big opportunity to both domesticate and modernize U.S. cement making,” said Sublime CEO and Co-founder Leah Ellis. The U.S. imports more than half of its cement, and Sublime’s technology could change that locus. Two factories in the Northeast have closed in the past 18 months because of outdated technologies.

Microsoft is the anchor customer for Sublime’s first commercial facility being built in Holyoke, Massachusetts, slated to begin deliveries in 2028. One of the biggest construction companies in the Northeast, Suffolk, announced a $3 million investment on May 21 to buy cement from the factory.

“Sublime’s mission is no less than fundamentally reshaping a cornerstone of the global built environment landscape, and we are proud to support them through our capital, our network and our commitment to building a more sustainable world,” said Jit Kee Chin, executive vice president and chief technology officer for Suffolk’s investment arm, Suffolk Technologies.

Credits for low-carbon cement and steel

Terms of the Microsoft-Sublime deal weren’t disclosed, but the company is positioning the contract as a way to provide early demand signals for the startup’s first factory, which will produce about 30,000 tons of cement annually. “Microsoft is a market maker,” Ellis said.

Sublime’s first commercial deliveries are slated for 2028; the startup hopes to support a full-scale facility with a capacity of 1 million tons potentially by 2030, she said.

Microsoft is using a new category of environmental attribute certificate (EAC) for concrete and steel to justify its investment. The certificates are legal mechanisms companies use to calculate emissions reductions. One common type is renewable energy certificates, which many businesses use to offset emissions from purchased electricity.

Environmental attribute certificates are used to spur investments in technologies that decarbonize hard-to-abate sectors including aviation, freight rail and maritime shipping. The new ones that will be issued under the Microsoft-Sublime deal are based on a methodology Microsoft developed with carbon management consulting firm Carbon Direct.

“While we prioritize deploying physical material whenever possible, this EAC approach helps both buyers and sellers overcome geographic, supply chain, cost and other barriers that make it challenging to introduce new technologies,” said Katie Ross, director of carbon reduction strategy and market development at Microsoft.

Goal: Scale availability of low-carbon cement

Microsoft’s purchases will be independently verified, although the details of how that will happen haven’t yet been determined, said A.J. Simon, director of industrial decarbonization at Carbon Direct. The certificates will be managed by a book and claim system, similar to what’s in place for sustainable aviation fuel.

The methodology published as a guide for other companies recommends that certificates be vetted using seven criteria, such as whether purchases will complement direct procurement of steel, cement and concrete.

“The intention is to set high-integrity standards for commodity EACs that will improve confidence in this mechanism,” Simon said. “The thresholds for quality in the report reflect Microsoft’s decarbonization; other companies may decide to weight the criteria differently.”

The prepurchase commitments made possible by the EACs act as accelerants for startups, Ellis said. Despite uncertain macroeconomic conditions, Sublime isn’t making big adjustments, and it’s working closely with three of the world’s largest cement producers — Holcim, Amrize and CRH — to focus on the long term. “This isn’t an industry that pivots quickly,” Ellis said.

The post How Microsoft’s deal with a low-carbon cement startup will cut its data center emissions appeared first on Trellis.