Diageo cautious on mid-term outlook amid US tariffs uncertainty

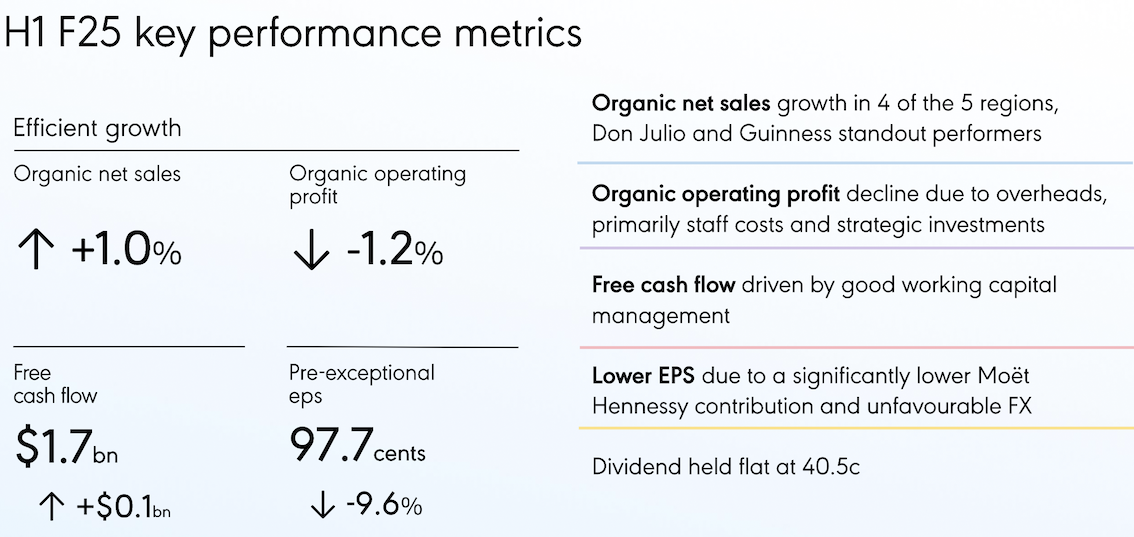

Leading drinks group Diageo today reported net sales of US$10.9 billion in the first six months of its final year to 31 December 2024, down by -0.6%, although organic sales returned to slight (+1%) growth.

Leading drinks group Diageo today reported net sales of US$10.9 billion in the first six months of its final year to 31 December 2024, down by -0.6%, although organic sales returned to slight (+1%) growth.

Reported operating profit declined -4.9% and reported operating profit margin declined 132 basis points, primarily due to unfavourable foreign exchange and a decline in organic operating margin.

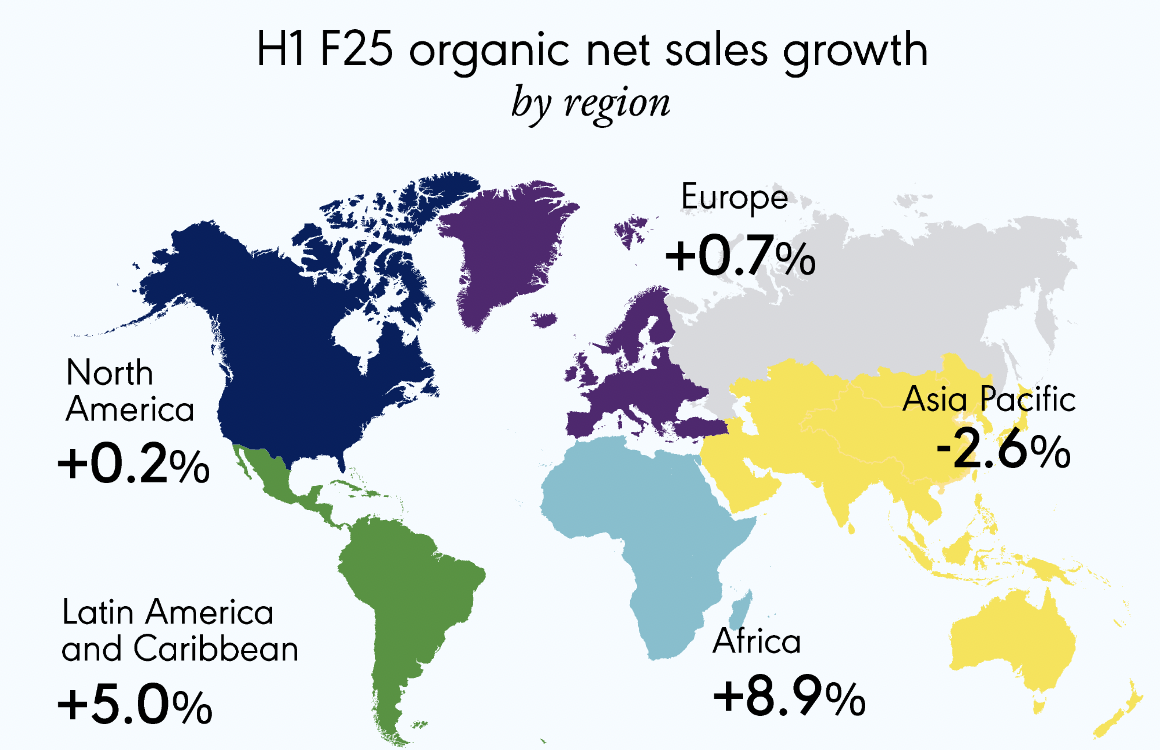

By region, Diageo reported +0.2% sales growth in North America and +0.7% in Europe, with a -2.6% decline in Asia Pacific, influenced by the macroeconomic picture in China. A “modestly improving consumer environment” helped underpin +5% growth in Latin America & Caribbean, while Africa grew by +8.9% year-on-year.

By category, Scotch was hit by soft consumer spend but leading brand Johnnie Walker gained market share; tequila posted +21% growth in organic net sales, with strengthening interest in aged expressions.

The company warned about the potential impact of US tariffs, which in turn meant that Diageo has put mid-term financial guidance on hold as it awaits further developments. Its previous guidance was for +5 to +7% organic net sales growth.

This weekend, US President Trump confirmed plans to introduce 25% tariffs on imports from Canada and Mexico, although these are now delayed by at least one month.

CFO Nik Jhangiani told investors that tariffs on Diageo products could potentially hit profits by US$200 million.

He said: “In the US, around 45% of net sales of our products sold must be made in either Canada or Mexico given geographic origin requirements. The key products which would see this impact input costs would be tequila which must be made in Mexico, and of course Canadian whisky.

“The vast majority of our net sales impacted is from Mexico. As a reminder, tariffs will be on the input cost, not the retail price.”

Chief Executive Debra Crew said: “Diageo has anticipated and planned for a number of potential scenarios regarding tariffs in recent months. The confirmation at the weekend of the implementation of tariffs in the US, whilst anticipated, could very well impact this building momentum. It also adds further complexity in our ability to provide updated forward guidance given this is a new and dynamic situation.”

Of the H1 performance overall, Crew said: “Our fiscal 25 first half results marked a return to growth, delivering organic net sales growth of +1% despite a challenging industry backdrop as consumers continue to navigate through inflationary pressures.

“Growth in four of our five regions was supported by market share gains. Notably, in North America, we outperformed the market with high quality share growth and positive organic net sales growth, driven by strong execution and momentum in Don Julio and Crown Royal. I’m also particularly proud of the performance of our iconic Guinness brand, which delivered double-digit growth for an eighth consecutive half, supported by brand building expertise, innovation and growing global momentum.”

She added: “While the pace of recovery has been slower in several key markets, we remain confident of favourable long-term industry fundamentals and more importantly in our ability to outperform the market.”