Celery Secures $6.25M Automate Financial Controls with AI

What You Should Know: – Celery, a financial operations platform leveraging artificial intelligence to automate internal controls secures $6.25M in seed funding led by Team8 Capital, with participation from Verissimo Ventures, Centre Street Partners, 97212 Ventures, and several strategic angel investors. This latest round brings Celery’s total funding to $9M. – The company was co-founded ... Read More

What You Should Know:

– Celery, a financial operations platform leveraging artificial intelligence to automate internal controls secures $6.25M in seed funding led by Team8 Capital, with participation from Verissimo Ventures, Centre Street Partners, 97212 Ventures, and several strategic angel investors. This latest round brings Celery’s total funding to $9M.

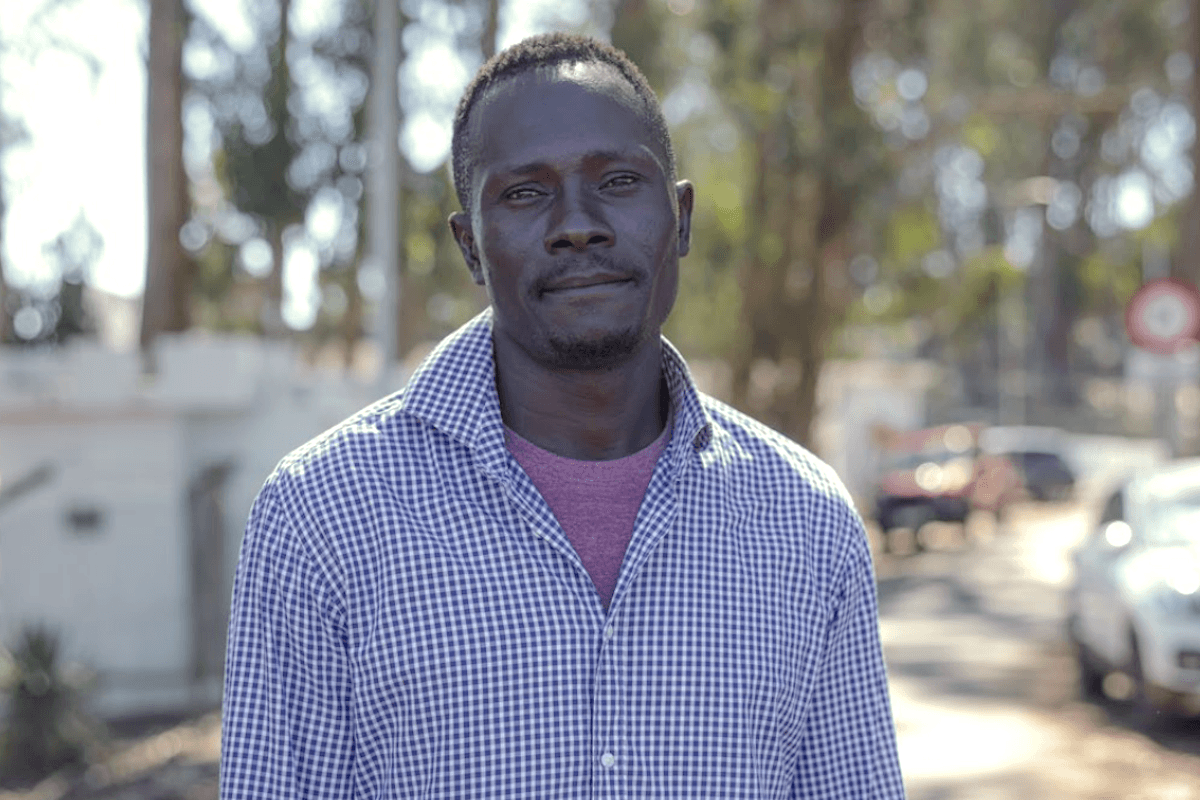

– The company was co-founded by Brot, a former startup CEO; Noam Slomianko, a serial entrepreneur and cybersecurity expert; and Hillel Shalev, a CPA and former biotech CFO who directly experienced the challenges of managing complex and error-prone financial systems.

Transforming Financial Oversight with Intelligent Automation

Designed with a focus on healthcare and other labor-intensive sectors such as construction, hospitality, and manufacturing, Celery’s platform aims to replace time-consuming manual financial reviews. Its intelligent audit agents are engineered to detect fraud, compliance risks, and financial inefficiencies in minutes, notably without requiring extensive software setup or system integration.

Celery has rapidly evolved from its initial offering as a payroll auditing tool, which identified discrepancies, policy violations, and overtime inefficiencies. It has now expanded into a comprehensive financial monitoring system designed to oversee corporate revenue and expenses more broadly. The company’s solutions are built to significantly reduce the burden of manual oversight and deliver tangible financial benefits.

“Finance leaders today are being asked to do more with less,” said Yuval Brot, CEO and co-founder of Celery. “Yet, financial controls are still being done manually—often across massive spreadsheets and disconnected systems. We built Celery to replace this outdated workflow with real-time, automated oversight that’s accurate, fast, and cost-effective.”

According to Celery, its platform can reduce manual oversight by up to 91%, achieve an average cut in payroll costs of 0.6%, and deliver an impressive 8x return on investment for its clients. To date, the company has processed over 430,000 payslips, analyzed more than $550M in payroll data, and has been credited with preventing $2.3M in losses for its customers.

Automating Healthcare Auditing Processes

Celery’s solutions are already being utilized by dozens of U.S. healthcare organizations. One notable example is New York-based provider Ultimate Care, which reported a reduction in annual overtime and billing discrepancies by more than $200,000 after adopting the platform. The healthcare provider found hidden payroll issues within weeks, achieved an immediate ROI, and successfully automated its auditing processes using Celery.

Expansion Plans

The newly acquired capital will be strategically deployed to expand Celery’s go-to-market operations and accelerate product development. A key focus will be the launch of new audit agents specifically targeting expense review, fraud detection, and fixed asset controls. Furthermore, Celery is actively exploring channel partnerships with payroll providers and accounting platforms to broaden its reach and integration capabilities.

“Finance leaders are under pressure to cut costs and ensure compliance, yet many still rely on manual oversight,” said Hadar Siterman-Norris, Partner at Team8. “Celery gives CFOs precision and visibility into risks hidden in their data, enabling smarter, leaner operations. With 82% of CFOs increasing fintech spend in 2025, this is exactly the kind of high-ROI solution they’re prioritizing. Automation is solving what manual reviews can’t.”

![The breaking news round-up: Decagear launches today, Pimax announces new headsets, and more! [APRIL FOOL’S]](https://i0.wp.com/skarredghost.com/wp-content/uploads/2025/03/lawk_glasses_handson.jpg?fit=1366%2C1025&ssl=1)