Carbon market downturn leads to staff cuts at Pachama

The young company is the third carbon credits player to announce cuts in recent months. The post Carbon market downturn leads to staff cuts at Pachama appeared first on Trellis.

Around 20 employees have been let go by Pachama, a carbon markets company that has won business from Salesforce, Boston Consulting Group and others by providing tools that can identify and monitor high-quality nature-based credits. Pachama’s cuts are the latest in a voluntary carbon market that has been roiled by wider economic uncertainty and anti-ESG sentiment.

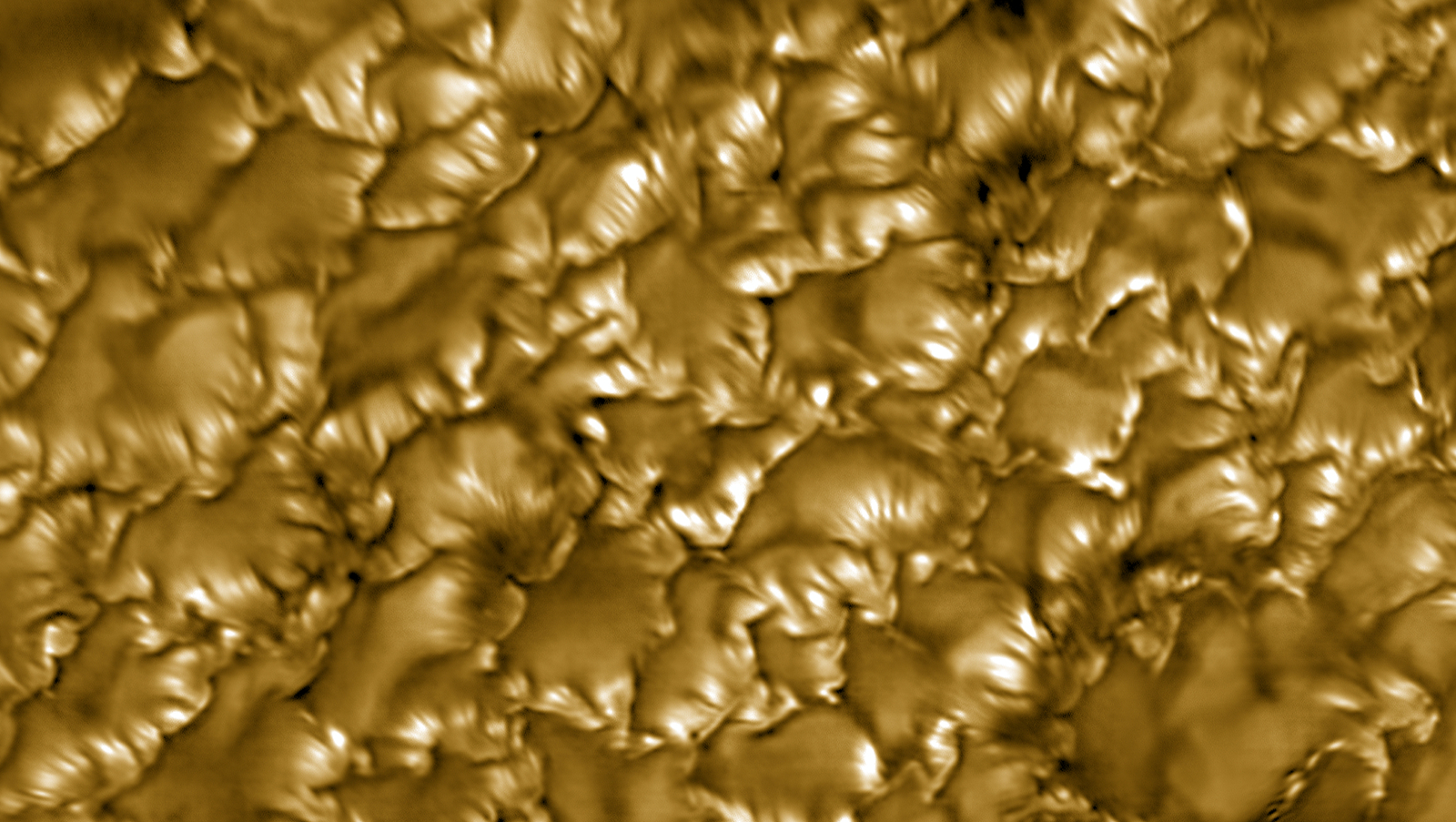

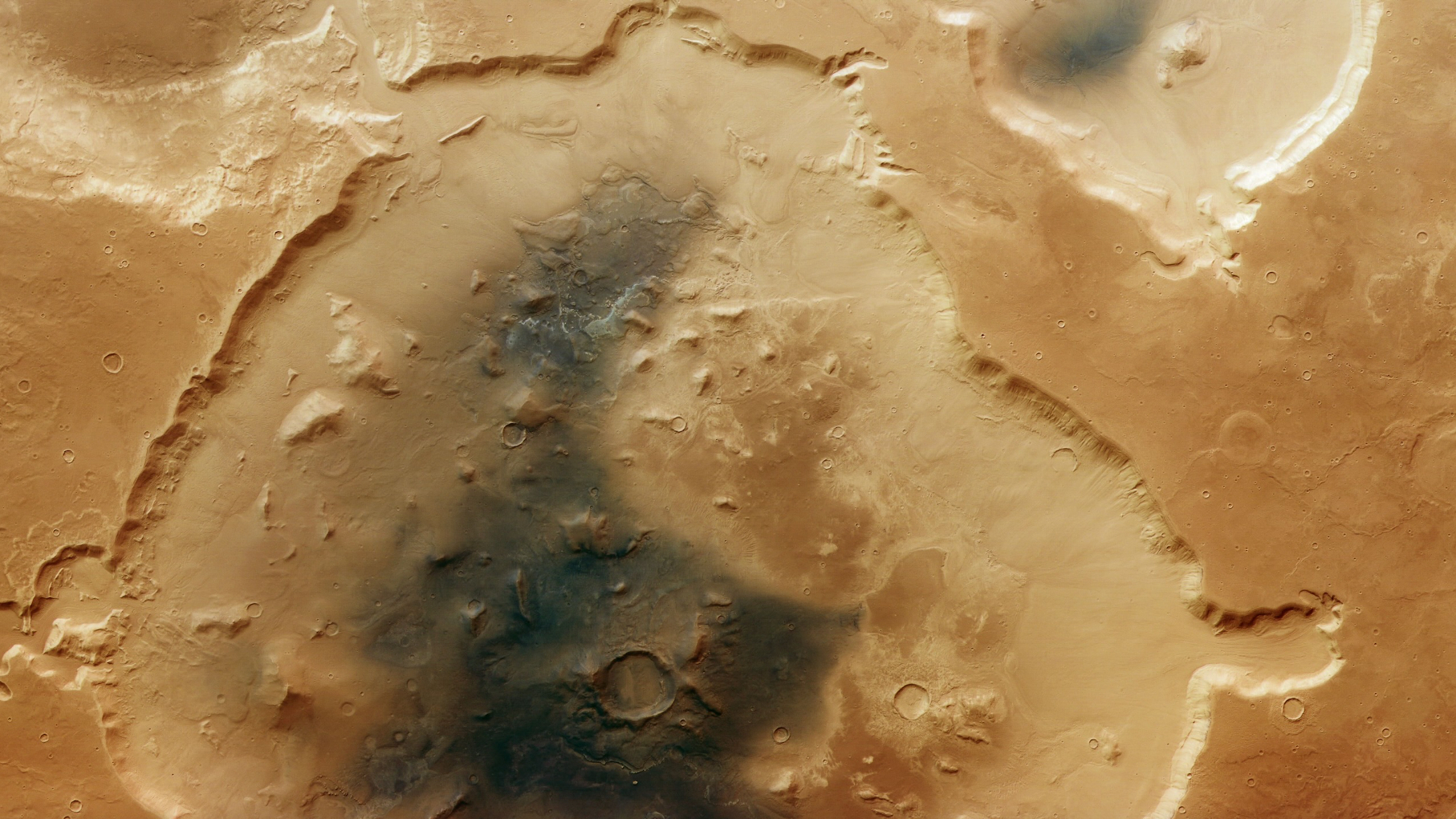

Pachama was founded in 2018 by Diego Saez Gil, an entrepreneur with a background in the travel industry. The company debuted as carbon credit buyers were becoming increasingly concerned about the quality of forest credits. The remedy it offered: due diligence tools based on remote sensing and artificial intelligence. By late 2023, Pachama had raised $88 million from big-name funds, including Breakthrough Energy Ventures and Amazon’s Climate Pledge Fund, as well as celebrity investors such as Serena Williams and Ellen DeGeneres.

The company had recently expanded into project development, but the departures, announced late last week, are part of what Saez Gil described as “a strategic shift back to Pachama’s original vision: building a technology platform powered by geospatial AI to help make confident investment decisions into nature-based climate solutions and sustainable land management.” Pachama’s headcount is around 35 after the layoffs, Saez Gill said.

That reduction in force is the latest in a series of setbacks for young carbon market companies. Heirloom, a direct air capture (DAC) project developer that has contracts with Microsoft and others, has laid off staff and cancelled a project since last November’s elections. Doubts about future federal funding for DAC are believed to be the cause. Last month, Climeworks, another DAC company, cited similar reasons for cutting just over 100 positions from a staff of around 480.

Roiled markets

Turbulence at the federal level hit these companies hard because the voluntary carbon market, a core part of all of their business models, is also going through an upheaval: Controversy over the integrity of some classes of carbon credits has spooked buyers. The total value of credits traded in 2024 was around $530 million, a quarter of the market size just three years earlier, according to data released last week by Ecosystem Marketplace, an information source for environmental markets.

“The current uncertain and volatile financial, economic and geopolitical climate, added to the anti-ESG agenda in the U.S., is indeed having an effect on corporate sustainability budgets,” Saez Gil told Trellis. “The impact is especially acute in the voluntary carbon market, which was already in a moment of correction.”

There are signs, however, that the market is doing a better job of rewarding higher-quality credits — a move that many observers see as critical to its long-term success. The Ecosystem Marketplace report, for example, notes higher demand for credits that have won approval from the Integrity Council for the Voluntary Carbon Market, an increasingly influential standards-setter. A shift away from cheaper, lower-integrity credits toward more expensive but reliable options, including high-quality forest projects and DAC, is a positive sign for all three of the companies hit by the recent layoffs.

The post Carbon market downturn leads to staff cuts at Pachama appeared first on Trellis.