Canoo Files for Bankruptcy, Another EV Startup Down

Canoo has officially run out of money, resulting in the all-electric vehicle company to file for Chapter 7 bankruptcy last week. The brand responsible for producing a versatile EV platform that could be adapted into numerous vehicle types has stated that the final straw was an inability to obtain funding from the U.S. Department of Energy’s Loan Program Office or source fresh investment from unnamed foreign sources.

Canoo has officially run out of money, resulting in the all-electric vehicle company to file for Chapter 7 bankruptcy last week. The brand responsible for producing a versatile EV platform that could be adapted into numerous vehicle types has stated that the final straw was an inability to obtain funding from the U.S. Department of Energy’s Loan Program Office or source fresh investment from unnamed foreign sources.

Formed in 2017, when it was still using the Evelozcity name, Canoo’s first product was a seven-seat EV the company believed to be used as a family hauler or modestly sized commercial shuttle. Its appeal was a minimalist, albeit futuristic, design and an ovoid body shape that helped maximize interior volume. Canoo likewise wanted to sell the vehicles under a subscription model — something which was being floated by loads of automotive startups at the time.

The claim was that Canoo would build small, adaptive EVs that would work as both passenger vehicles, commercial vehicles, and (eventually) fully autonomous shuttles. But it needed to start by manufacturing prototypes, which commenced late in 2019.

Several years later, the brand would debut a pickup variant of the model and claimed it would enter production in 2023. But not before it said it would launch small delivery vans that were designed to compete with the larger Amazon EVs produced by Rivian. The vehicle was said to serve as a “multi-purpose delivery vehicle” with other applications (e.g. food truck or mobile repair vehicle).

While the brand saw a lot of big-name partnerships, the resulting production targets were never met. Hyundai expressed an interest in the brand in 2020, announcing a partnership and plans to utilize Canoo’s platform to build EVs of its own.

But this was just the beginning. Canoo established partnerships with NASA and the United States Army. The latter simply wanted to test its EV to see if it could be utilized as a tactical vehicle, whereas the former just wanted an ultra-modern vehicle to be used as crew transports. These were spectacularly small orders. The same ended up being true with the U.S. Postal Service wanted to demo them. But the above helped paved the way for an agreement with Walmart to buy 4,500 delivery vehicles from the company. While we’ve covered Walmart fielding these along the West Coast, Canoo never reached the stated production figure. The actual number was closer to 20 units.

The only other places you might have come across Canoo vehicles in the wild were within locales trying to spend federal funding on green transportation initiatives. Canoo shuttles would occasionally appear as part of pilot programs in select cities (e.g. Atlanta) or within companies willing to manage all-electric rental fleets for businesses. However, these were short-lived.

There was a period where the company seemed to be on the right track. But there’s likewise been some skepticism whenever we’ve mentioned it in the past. In 2020, Canoo ended up merging with a special purpose acquisition company (SPAC) — something that has been broadly criticized in recent years.

SPAC mergers have become so ubiquitous among EV startups that would later go bankrupt that it’s almost cliche at this point. The purpose is to use a merger with a shell company to drive up the share price of an initial public offering (IPO). However, this has frequently resulted in the company’s valuation peaking within the first few months and then cratering as the relevant parties sell off shares before the stock becomes worthless.

Electric vehicle companies that merged with special purpose acquisition companies prior to going bankrupt include Lordstown Motors, Fisker, Protera, Electric Last Mile Solutions, and Faraday Future. Canoo is the most recent addition to that list, with the troubled Nikola looking to be next. While the premise of the SPAC merger is to drum up funding to ensure the company has a fighting chance, they’ve likewise been criticized as helping businesses abuse the market.

Determining if that is indeed the case could be a series of articles in itself. But special purposes and acquisition companies are viewed as both the only way to get new automakers off the ground and as a convenient way to launder money via a failing business. It all depends on who you ask and how things play out for the given company. However, they’ve been at the center of numerous EV startups that have met scandal and sudden failure over the last ten years.

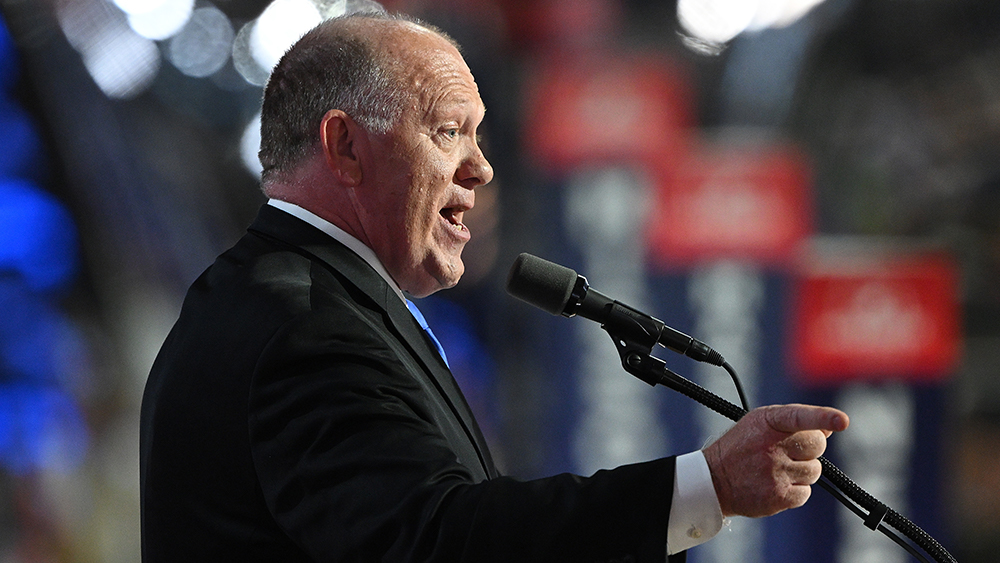

Canoo’s bankruptcy announcement has likewise encouraged legislators to criticize the government’s role in funding failing projects under the banner of environmentalism. Tom Gann, serving on the House of Representatives for Oklahoma’s 8th District, recently claimed Canoo was another example of the government wasting money on trying to pick winners and losers.

Oklahoma had previously gifted the business $15 million in state incentives to have it set up a production factory within its borders. The assumption is that the facility would secure thousands of local jobs and help set the stage for other businesses to come to the region. Obviously, things didn't work out as planned.

"Corporate welfare is when the government takes the public's money to manipulate the economy, choosing winners and losers in the free market," Gann stated. "In recent years, this practice has intensified, creating an era of corporate welfare on steroids, as Oklahoma government has pushed massive green-energy giveaways that align more with a liberal agenda than Oklahoma's conservative values."

"The bankruptcy of Canoo is yet another indicator that government must stop trying to pick winners and losers — they are terrible at it," he continued. "Despite my warnings, my advice was not heeded. Instead, numerous public benefits were lavished on CANOO. Now, three years later, Canoo has declared bankruptcy, once again proving the folly of these corporate giveaways.”

Considering that the company cited failing to secure additional funding from the government as the primary reason for the bankruptcy, Gann may have a point. But accusations have been thrown at the Trump administration, which everyone correctly assumed would undo executive actions taken by Joe Biden to free up tax dollars for all-electric vehicle programs. It would be reductive to claim that the Trump administration is ultimately responsible for Canoo’s failings. But it’s possible that it could have limped on for a few more years if the federal government was willing to keep on funding it. Still, that could be said of any business — no matter how badly it was performing.

Canoo’s board of directors have confirmed the brand will inform all stakeholders of plans to cease operations, effective immediately, and that the business will enter into liquidation. A court-appointed trustee will manage the sale of the company’s assets and is said to be closely collaborating with the Delaware Bankruptcy Trustee to assist with the process.

[Images: Canoo]

Become a TTAC insider. Get the latest news, features, TTAC takes, and everything else that gets to the truth about cars first by subscribing to our newsletter.

What's Your Reaction?