Whatever Happened to All Those American Electric Vehicle Startups?

After reporting on the Canoo bankruptcy announcement , several readers reached out to ask what had happened to the assets of other defunct EV startups — particularly those that went public via controversial special purpose and acquisition companies (SPACs). Who bought up their assets after bankruptcy and do any of them have any hope of still putting those original vehicle designs into production?

After reporting on the Canoo bankruptcy announcement, several readers reached out to ask what had happened to the assets of other defunct EV startups — particularly those that went public via controversial special purpose and acquisition companies (SPACs). Who bought up their assets after bankruptcy and do any of them have any hope of still putting those original vehicle designs into production?

Ask and ye shall receive.

The following companies were all promising-looking automakers attempting to enter the market by building all-electric vehicles before the established brands could ramp up production. While the nature of their downfall is unique, there is quite a bit of overlap in terms of production delays, repeated financial difficulties, an inability to secure lucrative contracts, and SPAC mergers that spiked the initial share price before it all came tumbling down. Let’s start with two of my favorites.

Lordstown Motors was founded in 2018 by Steve Burns, former founder and CEO of AMP Electric Vehicles (which later became Workhorse). Named for the Lordstown Assembly plant previously owned by General Motors, the company was focused on delivering an all-electric pickup truck based off the Workhorse W-15 under a licensing agreement in exchange for $12 million and a 10-percent equity stake in Lordstown Motors.

In 2020, the company reverse merged with a special-purpose acquisition company named DiamondPeak Holdings and became listed on the NASDAQ stock exchange. As with most SPAC deals, this yielded an incredibly high IPO. But the share price began to decline quickly and the company was criticized by the investment research firm Hindenburg Research — which accused Lordstown of fraud — just a year later.

Burns had already begun selling off shares and left the company in 2021 after several high profile vehicle fires and repeat announcements regarding production issues. That same year, Lordstown Motors announced a $230 million deal to sell the former GM plant to Foxconn Technology Group in exchange for the latter assembling its pickup. Foxconn would go on to sue Lordstown in 2023 for failing to follow through on investment promises and the company announced its bankruptcy shortly thereafter.

LAS Capital LLC bought Lordstown Motors' assets in September of 2023 for a stated $10 million. Its majority equity holder is Steve Burns, the same guy who sold off his shares for a tidy profit and left the company right before disaster struck. Lordstown has since been rebranded as “Nu Ride Inc.”

Faraday Future is another one of my favorite failed automotive startups because it shares a similarly scandalous history to Lordstown, just with a touch more mystery. Founded by Chinese businessman Jia Yueting in 2014, Faraday Future leveraged the name of a Western scientist (Micheal Faraday) who contributed significantly toward our understanding of electricity much like Tesla had. Early investments were often shadowy and assumed to stem from China. This became less of a secret after 2016 when it became public knowledge that the brand was failing to pay its bills after making major pieces of land in California and Nevada. Financial tie-ins with China’s LeEco (another company owned by Jia Yueting) could no longer be hidden and FF pivoted from establishing manufacturing to drumming up more investment capital.

The company’s founder would flee to the United States in 2017 to avoid paying debts after being placed on China’s debt blacklist over owing billions to creditors. However, things would only be marginally better in the United States where Yueting would declare bankruptcy in 2019. Meanwhile, Faraday had received $854 million from China’s Evergrande Group in exchange for a 45-percent stake in the company. Layoffs progressed and the company would be sold to a Chinese video game company right around the time Jia Yueting declared bankruptcy in the U.S. and stepped down as CEO.

Faraday announced that the company would go public through a reverse merger with special-purpose acquisition company Property Solutions Acquisition Corp. in 2021, with plans to partner with Geely and Foxconn. Initially valued at over $3 billion dollars, the company managed to see a handful of deliveries in 2023. But was still being eyeballed by the Securities and Exchange Commission, which had previously subpoenaed management over claims that it had misled investors. While the company has not yet officially filed for bankruptcy, a single share of its stock went from being valued at $177,000 to just $1.40 per share between 2021 and 2025. However, the most noteworthy happening over the last year is that Palantir Technologies Inc. purchased roughly 9 percent of the business last October.

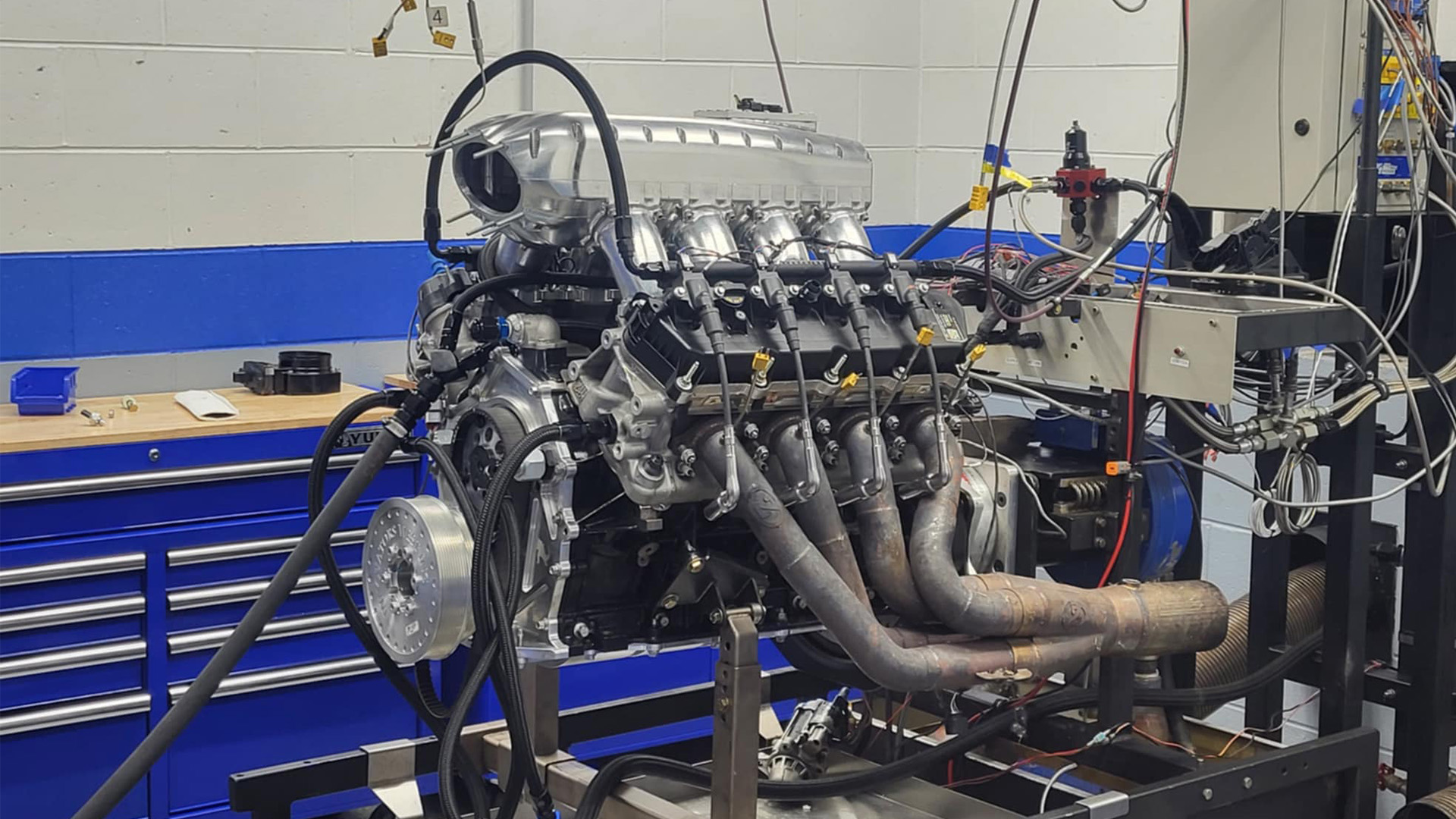

Nikola is another brand that, like Faraday Future, used the name of a famous scientist and didn't go bankrupt but seems like it’s dead in the water. Founded in 2014 by Trevor Milton, the brand wanted to build all-electric semi trucks before moving onto electrified pickup known as the Badger.

The Nikola Corporation announced its plans to merge with the SPAC VectoIQ Acquisition Corporation (run by former General Motors vice-chairman Stephen Girsky) in 2020. Shares quickly rose in value, with Nikola estimated to be worth over $13 billion just months after going public. But Nikola would be hit with a scathing report from Hindenburg Research accusing Milton of lying about the true number of vehicle registrations in order to sway investors.

NIkola’a CEO would resign shortly thereafter and General Motors would begin distancing itself from the business — as would other partners.

Its share price would plummet over the next several months and Milton would be incited for three counts of fraud by a United States federal grand jury in 2021. With stock prices now a shadow of what they were just a few years ago, Nikola has managed to deliver a few dozen all-electric vehicles and about 110 hydrogen-powered trucks. But this was not without incident, as the company has suffered from four major vehicle fires during testing.

Proterra wanted to do for buses what Nikola claimed it would do for semi trucks and met an even worse fate. Founded by Dale Hill in 2004, the company was led by individuals with a long history of building public transit and commercial vehicles. But Proterra’s goal was to take advantage of new federal incentives to build buses using alternative powertrains and forms of fuel. The company would field numerous prototypes and even several all-electric buses that would be sold to local transit authorities.

The business would move from Colorado to North Carolina during this period. In 2015, Proterra was awarded a $3 million grant from the California Energy Commission to fund the design, development and construction of new all-electric buses to be used in the state and relocated to the West Coast.

Proterra would become publicly traded after a reverse takeover of a special-purpose acquisition company, ArcLight Clean Transition Corporation, in 2021. It filed for Chapter 11 bankruptcy less than two years later. The brand had failed to meet supplier contract commitments and was reportedly way behind on vehicle deliveries. The battery and drivetrain division would be sold to Volvo in 2023, while the bus-making side of the business went to Phoenix Motorcars and the charging infrastructure tech went to Cowen Equity.

Those are the juicer tales of EV startups enjoying the SPAC boom before busting. But they’re hardly the only ones. You’re probably familiar with Fisker Inc. — builder of the Ocean EV. But you might not be familiar with Fisker Automotive, which built the original Karma EV.

Fisker Automotive went bankrupt in 2013 and its assets were sold to China’s Wanxiang Group, just months after the founder (Henrik Fisker) left the company. He would go on to launch Fisker Inc., whereas Wanxiang would reband the company as Karma Automotive. Karma would go onto sue Lordstown over technological disputes in 2020.

That same year, Fisker Inc. would go public through a reverse merger with a blank-check company backed by the SPAC Apollo Global Management. Fisker Inc. declared bankruptcy in 2024 after leadership claimed partnered deals with larger automakers fell through.

With Canoo and Electric Last Mile Solutions likewise having followed the special purpose acquisition company pathway from richest to ruin, it genuinely seems like these kinds of deals effectively guarantee the demise of an EV startup. The only genuine winners seem to be the executives that manage to sell off shares before the business’ stock price dives. But even this runs the risk of being targeted for financial malfeasance, which frankly looks to be rampant within several of the above companies.

But one wonders how much of that is intentional. Some of the above companies overtly misled investors and capitalized on government funding backed primarily by lies. Others appear to have simply failed in their mission by losing support from established automakers and managing their assets in a less-than-ideal manner. The only real constant seems to be the abundance of hype around alternative energy technologies, involvement of special purpose and acquisition companies, largely absent products, founders jumping ship, and Chinese investors either injecting money to boost the company at launch or scooping up the remaining assets once it declares bankruptcy.

The future of EV startups seems rather hazy at the moment. The current administration has announced that the United States will be shifting away from subsidizing EVs, so there will be less money to incentivize their existence in the coming years. While some have suggested that this will stymie progress on electrification, others have argued that it will make the industry more competitive. Your author’s assumption is that there is truth to both claims, with the real issue being public sentiment.

With artificial intelligence becoming the new hot ticket for investors (and many of the surviving automotive startups), electrification simply won’t receive the same kind of investments that it used to. In 2016, there was so much hype around electrification that funding seemed to be a given. Companies just needed some slick marketing and the promise of an eventual product. But the EV space seems pretty well saturated at the moment and companies clearly want to shift the investment buzz toward the promise of A.I. before it is likewise replaced by something else a few years down the road.

[Images: Faraday Future; Lordstown Motors; Nikola; Proterra; Fisker Automotive; Canoo]

Become a TTAC insider. Get the latest news, features, TTAC takes, and everything else that gets to the truth about cars first by subscribing to our newsletter.

What's Your Reaction?