LVMH profits slide amid tough trading climate in 2024

DFS Group, which saw business activity remain below its 2019 pre-Covid level, was hard hit in particular by exchange rate fluctuations, said LVMH.

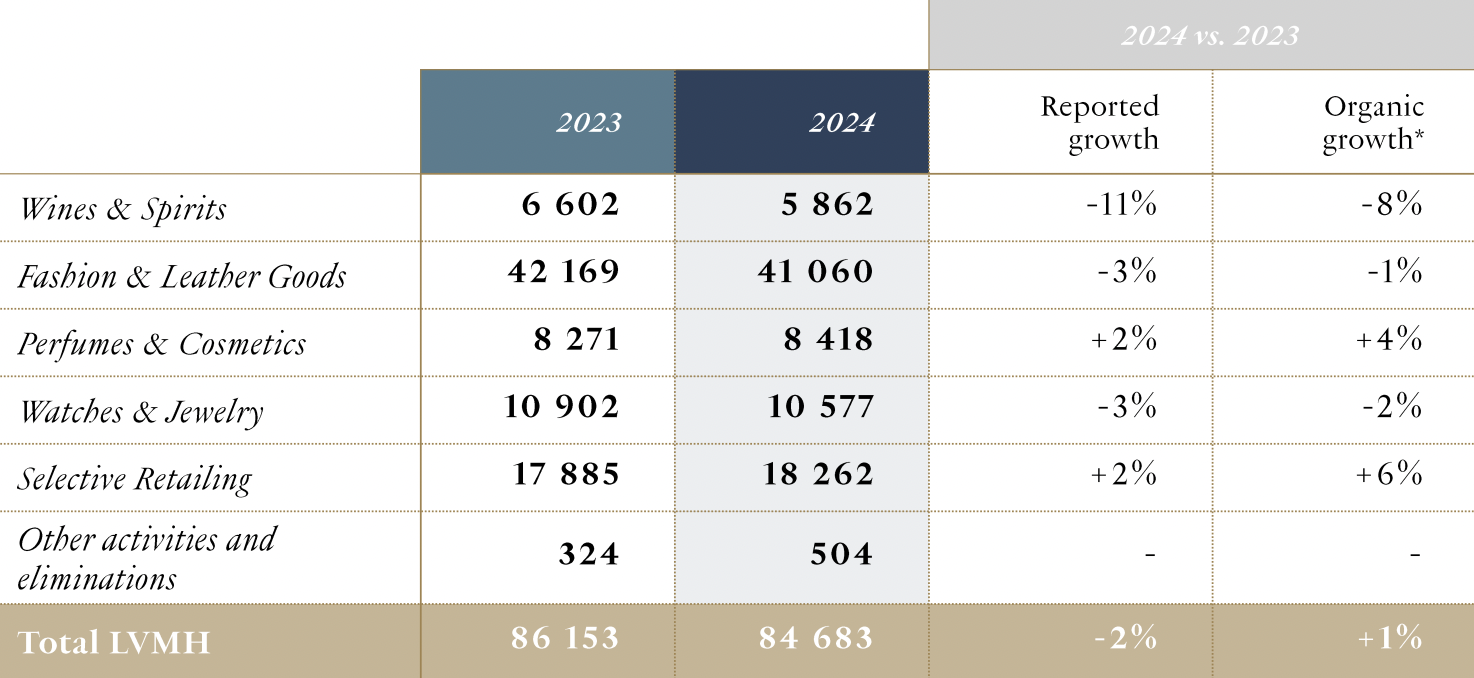

INTERNATIONAL. Leading luxury goods group LVMH Moët Hennessy Louis Vuitton recorded revenue of €84.7 billion in 2024, a rise of +1% year-on-year on an organic basis.

The slight growth came against the backdrop of a “challenging economic and geopolitical environment, as well as a high basis of comparison following several years of exceptional post-Covid growth”, said the group in a statement.

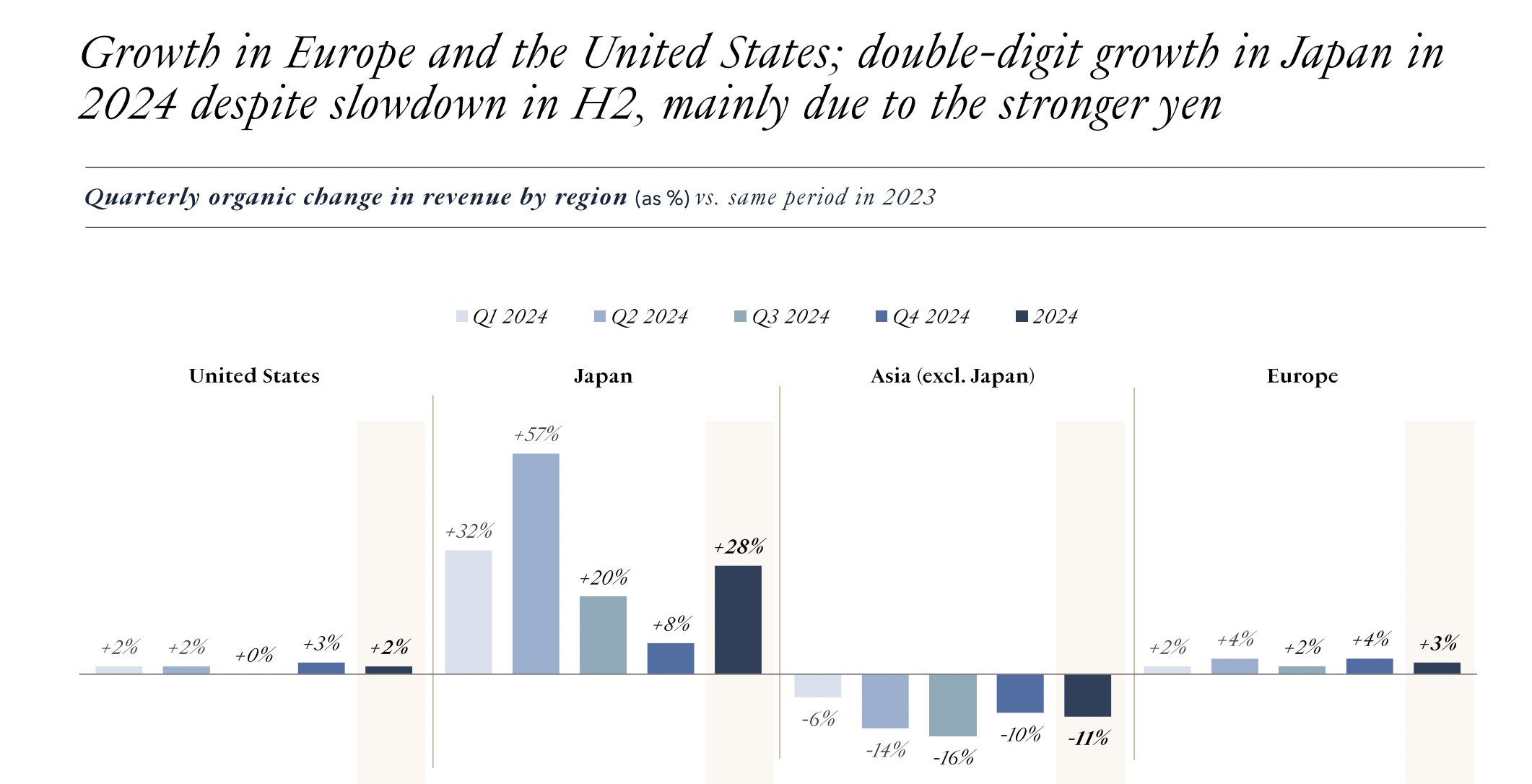

Europe and the USA posted growth on a constant consolidation scope and currency basis; Japan saw double-digit revenue growth; there was also encouraging spending by Chinese customers in Europe and Japan.

Profit from recurring operations for 2024 came to €19.6 billion, down by -14%, with an operating margin of 23.1%, exceeding pre-Covid levels. Exchange rate fluctuations had a negative impact during the year, particularly on Fashion & Leather Goods and Wines & Spirits. The Group share of net profit amounted to €12.6 billion, down by -17% year-on-year.

The Selective Retailing business group posted organic revenue growth of +6% while profit from recurring operations remained stable. DFS, which saw business activity remain below its 2019 pre-Covid level, bore the impact of China’s economic slowdown on Chinese customers’ buying behaviour, said LVMH, and was hard hit in particular by exchange rate fluctuations.

Of DFS, the group noted a solid performance in Japan and at US airports, “but lower at flagship destinations” such as Hong Kong and Macau. LVMH also highlighted the planned closure of the upscale Fondaco dei Tedeschi store in Venice later this year.

LVMH added: “DFS undertook a series of structural initiatives to boost its competitiveness, streamlining operations and reallocating resources to the most profitable regions to secure its long-term growth potential.”

(Click here for more on the strategic restructuring plan, as outlined by DFS Group Chairman & CEO Ed Brennan to Martin Moodie in a recent exclusive interview.)

Revenue for the Wines & Spirits division was down -8% (organic). Profit from recurring operations was down -36%, notably due to exchange rate fluctuations.

The Fashion & Leather Goods business group, which was broadly stable in terms of organic growth in 2024, showed solid resilience. Profit from recurring operations was down -10%, mainly affected by exchange rate fluctuations.

The Perfumes & Cosmetics business group achieved organic revenue growth of +4% with profit from recurring operations down -6%.

Revenue in Watches & Jewelry decreased by -2% on an organic basis in 2024. Profit from recurring operations was down -28%, partly due to investments in store renovations and communications, as well as exchange rate fluctuations.

LVMH Chairman and CEO Bernard Arnault commented: “In 2024, amid an uncertain environment, LVMH showed strong resilience. This capacity to weather the storm in highly turbulent times – already illustrated on many occasions throughout our Group’s history – is yet another testament to the strength and relevance of our strategy.

“The creativity and very high quality of our products, our steadfast commitment to excellence, the agility of our teams and the good geographic balance of our locations underpin the success of LVMH and its Maisons, backed by the dedication of all our people.

“This dedication was also behind one of the Group’s finest collective achievements of 2024: LVMH and its Maisons’ partnership with the Paris 2024 Olympic and Paralympic Games, which helped make the world’s foremost sports competition a resounding success and showcased French expertise and craftsmanship on the global stage.

“We were also glad to witness the reopening of Notre-Dame Cathedral in Paris at the end of the year, even more beautiful following its restoration, which took place with support from donors including LVMH.”