European Digital Health Startups Face ‘Existential Risk’ Amid Funding Pullback and ROI Demands, New Report Finds

What You Should Know: – A new report from Black Book Research reveals significant headwinds facing the European digital health sector, with a survey of 54 early-stage startups highlighting investor pullback, cross-border scalability challenges, and increasing demands from health systems for evidence-based ROI. – The findings paint a picture of a market in a “precarious ... Read More

What You Should Know:

– A new report from Black Book Research reveals significant headwinds facing the European digital health sector, with a survey of 54 early-stage startups highlighting investor pullback, cross-border scalability challenges, and increasing demands from health systems for evidence-based ROI.

– The findings paint a picture of a market in a “precarious holding pattern,” where many innovative companies are struggling to survive.

Pandemic-Era Winners Now Facing Burnout

According to the study, 62% of early-stage startups are currently relying on bridge or extension rounds to remain operational amid tightening venture capital markets. A striking 41% report they face existential risk if they do not secure additional investment or demonstrate commercial traction within the next 6 to 12 months. Startups in digital therapeutics and telehealth, two sectors that experienced hypergrowth during the COVID-19 pandemic, are now proving to be particularly vulnerable. The Black Book report found that:

- 55% of these companies report unsustainable burn rates as they struggle to align fixed costs with a normalized market demand.

- 48% report difficulty demonstrating a clear return on investment (ROI) to health system buyers, a trend that is contributing to delayed procurement decisions and dropped pilot programs.

Distress M&A and Strategic Retrenchment on the Rise

As revenue growth plateaus and valuations reset, the report indicates a clear trend toward consolidation and downsizing. 39% of the surveyed startups say they are actively considering distressed mergers, acquisitions, or internal downsizing to stay afloat. This mirrors the challenges faced by larger European firms like Doctolib, which, despite its early momentum, has encountered difficulties in balancing growth with profitability.

European Digital Health Market Challenges

The report highlights three structural barriers that uniquely burden European digital health ventures and hinder their ability to scale effectively:

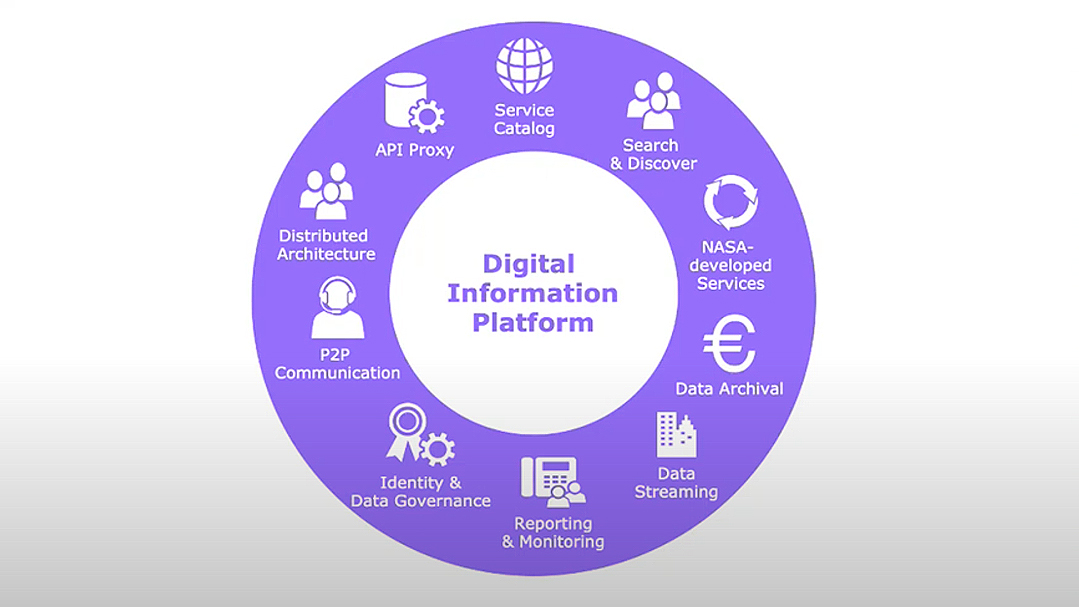

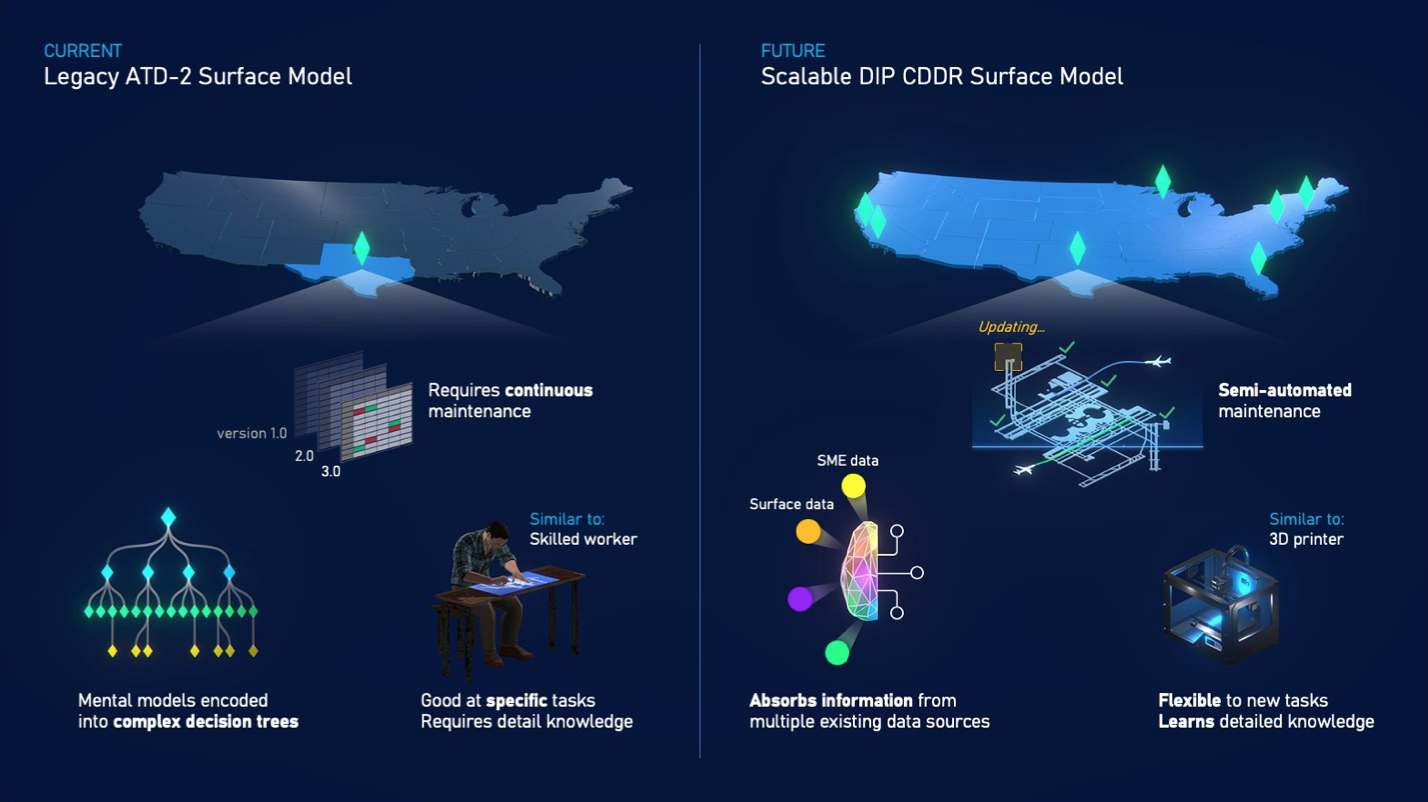

- Fragmented Health Systems: Pan-European scale remains elusive due to varying regulatory standards, reimbursement models, and EHR interoperability frameworks. This forces digital health companies to localize their offerings extensively, which inflates go-to-market costs and slows adoption.

- A Challenging Funding Environment: Since peaking in 2021, health tech funding in Europe has fallen sharply, with growth-stage and late-stage startups being the most affected. Many institutional investors have redirected their capital to biotech, AI infrastructure, or U.S.-based ventures that offer the potential for faster growth.

- Intense Demand for ROI: European health systems now demand rigorous clinical and economic validation. Startups that overbuilt during the pandemic without a sustainable model are finding themselves deprioritized, especially those unable to provide credible data on cost savings or improved outcomes.

“The fundraising bar for Series A has shifted dramatically since 2022,” said Doug Brown, Founder of Black Book. “Venture capital firms are demanding later-stage metrics at earlier phases. Without meaningful revenue or real-world impact data, HIT startups are stuck in a precarious holding pattern.”

Black Book’s findings reflect a market in a critical transition. While digital health remains a long-term priority, early-stage companies are calling for better alignment of reimbursement policies and pan-EU regulatory support. As Brown concludes, “The European market doesn’t suffer from a lack of ideas. It suffers from systemic frictions that stall even the most promising innovations from reaching scale.”