Pre-crackdown daigou rush sees South Korean duty-free sales spike in December but profitability crisis deepens

In the so-called Land of the Morning calm, circumstances in the duty-free market are anything but serene. And while sales saw a sharp month-on-month spike in December, heavy retailer losses are currently the name of the game.

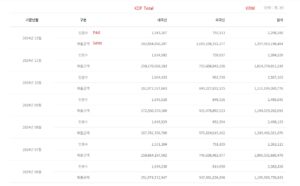

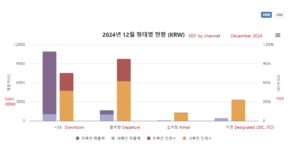

SOUTH KOREA. Total duty-free retail sales (excluding inflight) rose almost +24% month-on-month in December but eased -3.8% year-on-year to KRW1,257,963,198,484 (US$874.7 million), according to latest Korea Duty Free Association figures.

The month-on-month spike was partly down to a late-year daigou buying surge before the Lotte Duty Free cessation of the bulk wholesale trade in January, according to informed observers.

“December sales were up due to a cramming of the daigou traders business before the Lotte Duty Free ban but the financial loss situation faced by retailers is severe,” a senior Korean duty-free executive told The Moodie Davitt Report. That view was borne out by the Q4 performance of Hotel Shilla, parent company of The Shilla Duty Free, which this month posted a KRW43.9 billion (US$30.7 million) travel retail operating loss.

The widening deficit, up +47.8% year-on-year and +13.4% quarter-on-quarter, underlines the huge pressures facing The Shilla Duty Free and its Korean travel retail peers in the crisis-hit downtown sector.

Nationwide customer numbers in December were down -4% month-on-month to 2,298,280, again suggesting a temporary rise in bulk buying.

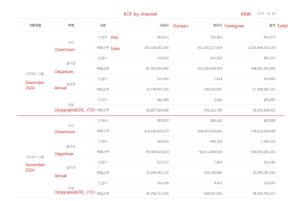

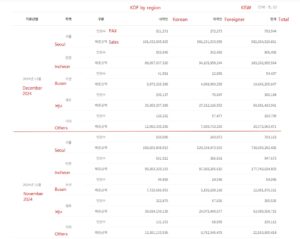

That conclusion is supported by a +34.3% month-on-month increase in spending by foreigners (80.7% of total sales but just 32.9% of total customers, as shown in column 4 in the table below) to KRW1,015,108,332,277 (US$705.7 million), despite an -0.7% reduction in customer numbers.

Spending by Koreans slipped -6.3% compared with November (-4.2% year-on-year) to KRW242,854,866,207 (US$168.9 million). Korean customer numbers declined -5.6% month-on-month and -0.07% year-on-year to 1,543,167.

Downtown duty-free sales, dominated by foreigner purchases (though not customer numbers), surged +31.6% month-on-month (-6.6% year-on-year) to KRW1,090,498,796,455 (US$758.1 million). Customer numbers downtown reached 891,474, down -0.6% month-on-month and up +18.7% year-on-year.

The Korean spend in airport departures stores fell -2.1% month-on-month (-3.5% in customer numbers) and -6.4% year-on-year (-7.2% in customer numbers).

Downtown, Korean spending decreased -7.82% month-on-month but rose +1.4% year-on-year. Korean customer numbers downtown fell -6.3% month-on-month but grew +18.7% year-on-year.

Note: For a comprehensive evaluation of the reseller business entited ‘The past, present and future of the South Korean duty-free industry’, click here.

Note: For a comprehensive evaluation of the reseller business entited ‘The past, present and future of the South Korean duty-free industry’, click here.

![From Gas Station to Google with Self-Taught Cloud Engineer Rishab Kumar [Podcast #158]](https://cdn.hashnode.com/res/hashnode/image/upload/v1738339892695/6b303b0a-c99c-4074-b4bd-104f98252c0c.png?#)