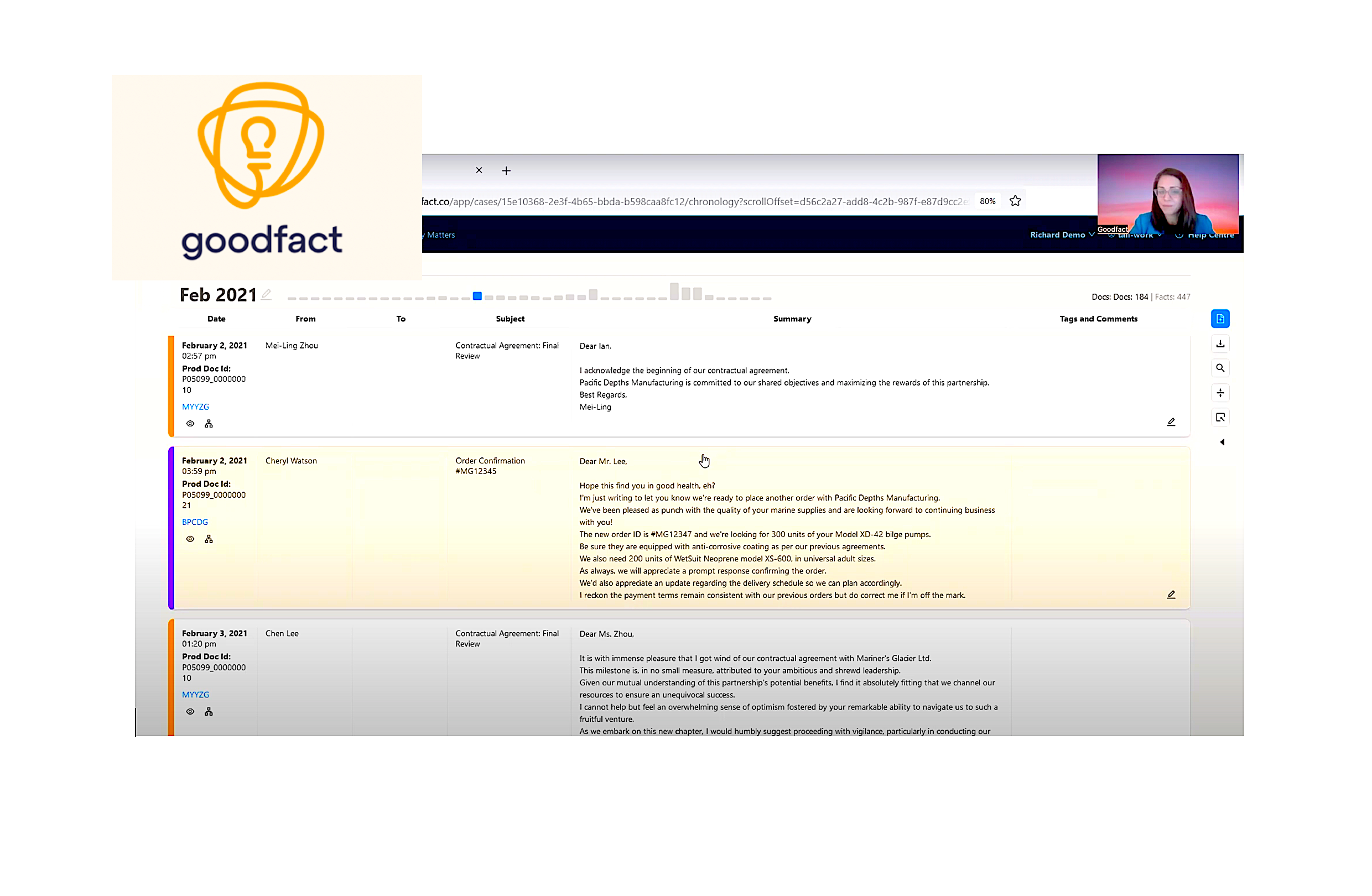

China's huge talent pool gives it an edge in the global EV race, says CATL exec

China can tap a large software engineer talent pool from its consumer-focused companies, Pan Jian of battery maker CATL told the World Economic Forum.

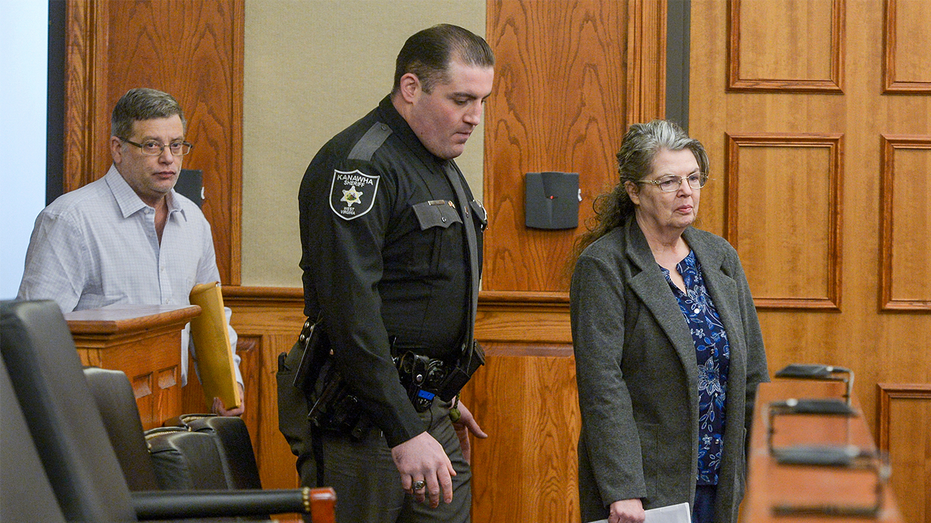

Jakob Polacsek/World Economic Forum

- China's talent pool of software engineers has boosted its EV industry, CATL's co-chairman said.

- Pan Jian told the World Economic Forum that companies such as Xiaomi and Tencent had given China an edge.

- Sales of EVs in China are set to overtake conventional cars this year for the first time.

A talent pool of software engineers and startups is giving Chinese manufacturers a key advantage in the global electric vehicle race, the co-chairman of the world's largest EV battery manufacturer said.

Pan Jian of CATL, a key Tesla battery supplier, said: "They have the benefit of tapping into a very huge talent pool, a software engineer talent pool, cultivated by the internet consumer and smartphone businesses in the past." They included companies such as Xiaomi and Tencent.

That meant Chinese automakers could draw on a wealth of technical expertise compared with rivals in the US and Europe.

Pan made the comments at a World Economic Forum panel in Davos, Switzerland on Tuesday.

The session was moderated by Jamie Heller, Business Insider's editor in chief, and other speakers included Jakob Stausholm, the Rio Tinto CEO, and South African science minister Bonginkosi Emmanuel "Blade" Nzimande.

CATL makes batteries for EVs and was added to a Pentagon blacklist earlier this month.

Booming sales

EV sales in China are set to jump 20% this year to more than 12 million, overtaking conventional car sales for the first time.

Government incentives and intense price competition among players including BYD, Xpeng, Zeekr, and Nio have boosted EV sales in China.

Smartphone giants like Xiaomi and Huawei have also entered the EV market, with Xiaomi's $30,000 SU7 electric sedan surpassing 100,000 sales last year and wowing Ford CEO Jim Farley. Mark Andrews

Amid a brutally competitive environment, automakers have faced pressure to offer affordable EVs packed with advanced technology.

Models such as the SU7 and Xpeng's P7+ come with voice control, giant infotainment screens, and advanced autonomous driving features, while luxury options including BYD's Yangwang U8 are packed with futuristic extras such as on-board drones.

Pan said that while government incentives had helped set up the market, these "intelligent" features were a big factor in booming sales of Chinese EVs.

"It's a perfect common marriage between electrification and intelligence," he said. "Electrification enables intelligence, so that offers a whole suite of new features to consumers which cannot be offered with traditional combustion-engine cars."

In contrast, electric vehicle sales in the US have slowed, with a host of automakers scaling back plans in favor of hybrids in response to tepid demand.

Several have also backed away from advanced technologies such as robotaxis, with General Motors cutting funding for robotaxi firm Cruise last year. VCG/VCG via Getty Images

"I think for the US and European market today, the bottleneck really lies in the software development capability with the traditional auto companies," said Pan.

He said Western companies needed to "embrace automaking in the new era, which has a heavy software component in it."

Supply chains

China's EV dominance extends to the supply chain, with numerous US and European automakers dependent on batteries made by CATL or BYD, the two largest battery manufacturers, to power their EVs.

Attempts to challenge China's battery giants have met with mixed success, with Swedish battery startup Northvolt filing for bankruptcy late last year amid stuttering demand for EVs in Europe.

As a result, some Western manufacturers are forging links with CATL. Stellantis announced in December it would build a battery factory in Spain with the Chinese company, and Pan said other automakers could soon follow the Jeep and Ram owner's lead.

"Hopefully this year, we will be able to announce some other major joint venture efforts in Europe with other automakers," he said. "It's not healthy … to concentrate too much production capacity in one place."

What's Your Reaction?

![[FREE EBOOKS] Hacking and Securityy, The Kubernetes Book & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![AI in elementary and middle schools [NAESP]](https://dangerouslyirrelevant.org/wp-content/uploads/2025/01/NAESP-Logo-Square-1.jpg)