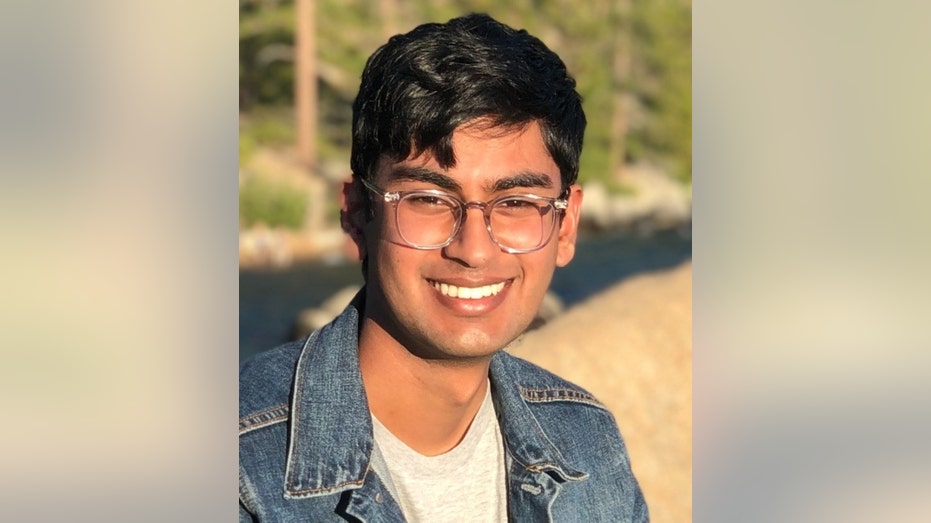

A millennial who 'never paid a dollar of rent my entire life' shares how he bought his home for $25,000 under asking in a competitive, post-Covid market

Carmelo Camilleri saved significantly throughout his 20s by living at home, using price comparison apps, and refusing to pay for subscriptions.

Courtesy of Carmelo Camilleri

- After years of diligent saving, Carmelo Camilleri bought his first home at age 27 in 2021.

- He credits his savings habits to his dad, who also taught him to 'always own, never rent.'

- Thanks to smart negotiation and patience, he bought the home for $25,000 below the asking price.

The first time Carmelo Camilleri made a significant amount of money, he was 19 and had just wrapped up his freshman year of college.

He landed a summer gig as a sales rep and, within two months, made about $7,000 selling Cutco knives, he told Business Insider: "At the time, I thought I was rich."

His dad quickly shot down that notion.

"The first thing my father said to me was, 'Don't spend it. Put it away,'" recalled Camilleri. "And I said, 'What do you mean? I have this money. I should be able to use it.'"

His dad responded by teaching him about what happens when you overspend, accumulate debt, and incur interest. Rather than having compound interest work against him, he could take advantage of the phenomenon by investing his money.

It resonated and, from that point on, Camilleri adopted a new savings philosophy: "I just said to myself, 'If I make a dollar, I can only spend 10 cents of it at most.'"

That early money lesson, plus one more from his dad — "he taught me, 'always own, never rent,'" — led to Camilleri becoming a homeowner at age 27 when he purchased a five-bedroom in Brick, New Jersey in 2021. BI verified his ownership by looking at a copy of his mortgage statement.

"I was always going to buy a home. It was just a matter of when — not if," he said.

Saving up for a down payment: Living at home, using price comparison apps, and refusing to pay for subscriptions

Camilleri financed his home purchase with a 20% down payment, drawing from savings he'd accumulated throughout his early 20s.

He maintained the disciplined savings habits he established in college even as his income grew in his full-time sales role — and he avoided paying for housing for years. He lived with his parents in his childhood home until he bought his own place, meaning "I never paid a dollar of rent my entire life," he said.

Camilleri refuses to pay for subscriptions, which he considers "the biggest scam out there." He does have access to YouTube TV — his cousin gave him his login — and, "I jailbroke my FireStick," he said. "There's always a way to watch things for free."

He also refuses to pay top dollar for gas and groceries.

"If it's not the cheapest gas in the area, I'm not getting gas," said Camilleri, who uses the GasBuddy app. Courtesy of Carmelo Camilleri

As for groceries, ShopRite tends to be the cheapest option in his area, but if they raise the prices on one of his staples, like ground turkey, he'll shop around.

"If I see it went up 50 cents a pound, I'll take out my phone, and I'll start looking at other stores," he said. "I'll look at Stop & Shop, and if I see that it's 50 cents less or even 25 cents less per pound, I'm getting into my car, and I'm driving five minutes away. It's worth it in my head, especially because I like to buy in bulk."

At this point, his frugal habits are ingrained.

"This is how I live my life. I get the best deals on everything, and I never buy at the first price. I'm always trying to negotiate. I'm always looking to get the best price I possibly could," said Camilleri. That said, there's a time and a place to splurge, he added, pointing to his upcoming wedding. "I'm not being frugal when it comes to the wedding, but that's also because it's a once-in-a-lifetime opportunity."

Paying $25,000 under asking thanks to patience and smart negotiation

When Camilleri started seriously considering buying a home in 2020, interest rates were low, but the market was hot.

"At least in New Jersey, so many of the houses I looked at were going for $100,000 over asking price, $50,000 over asking price," he said. He wasn't willing to overpay, and living at home allowed him to be patient. "It's not like I had to move out."

Camilleri's patience paid off after a year of house hunting. He not only avoided a bidding war — he landed on a price that was $25,000 lower than what the seller was originally asking. He paid $670,000 for the 2,300-square-foot home.

It was part skill and part luck.

"I'm literally negotiating over the phone and making sales all day long. It's what I do for a living. I understand how negotiations work," he said. "I knew they weren't going to accept my first offer, but I started about $50,000 under asking, then they came back with a little bit higher than I wound up paying, and then we found some middle ground."

He added that lowballing wouldn't work in every situation: "It really depends on the demand for that home. If there were 10 people bidding on the home, I'm sure it wouldn't have worked out in my favor. In this instance, I do actually feel like I might have gotten lucky because it is a beautiful home."

He locked in a 2.875% interest rate, which still seems surprising to him: "You don't get that in New Jersey."

Even though his rate was "a steal," he said, "if I had no other choice and I had to pay 7%, I would still do that every single time over renting."

The way he sees it, it's much more costly to rent than to own.

"When you're renting, you're literally building someone else's asset. You're paying 100% interest is the way I like to describe it — because you're literally getting nothing back: You put a dollar in, that dollar is gone forever," said Camilleri. "Even if the interest rate is high, it's still something you own. It's still something that will build in value over time and that you have control over."